Latest

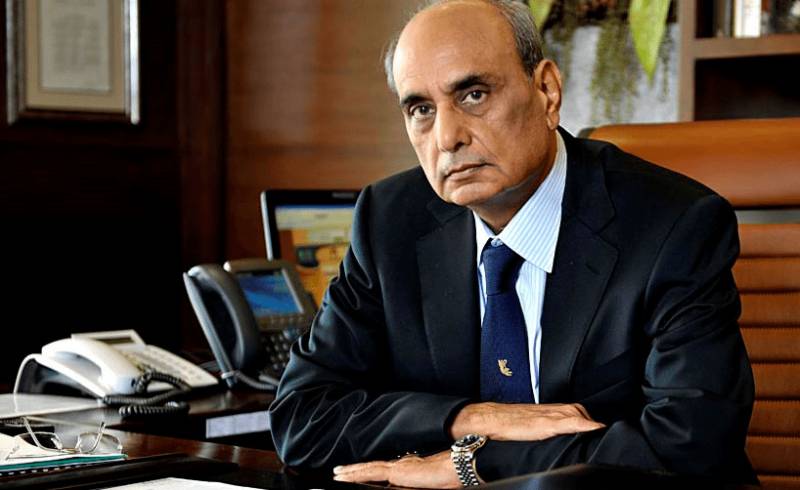

Mian Mansha seeks media restraint, legal representation in ‘frivolous’ NAB probe

06:45 PM | 18 Mar, 2019

LAHORE – Pakistan’s leading business tycoon, Mian Muhammad Mansha is being targeted by a segment of media over false and defamatory allegations pertaining to the purchase of a luxury hotel in the United Kingdom nearly a decade ago, according to sources close to the matter.

Last week, the chief executive of Nishat Group was interrogated by a three-member team of National Accountability Bureau (NAB) for 45 minutes where he was questioned for the purchase of London’s Saint James Hotel and Club.

The St James's Hotel and Club is a hotel at 7-8, Park Place, St. James's, London SW1A 1LP. The hotel is part of the Lahore-based Nishat Group since it was bought in November 2010. The hotel has fifty-six rooms and twelve suites, many of which have their own terraces, plus a penthouse with a party deck for sixty people.

Moved by a complaint, the anti-graft watchdog last Thursday (March 14) recorded Mansha’s personal statement against the allegations of illegally transferring funds to United Kingdom (UK) from Pakistan.

It has also been revealed that a false and frivolous writ petition WP#358 of 16 earlier was filed with Islamabad High Court by Pakistan Welfare Party through its Chairman Farooq Sulehria (the petitioner/complainant), alleging therein that Mian Mohammad Mansha’s family acquired the St. James Hotel and Club, London in 2010 for total consideration of £60 million, equivalent to PKR 9 billion.

It was alleged in the petition that the funds used for the purchase of this Hotel were not legal; hence a charge of money laundering was levelled against Mr. Mansha’s family, impleading NAB, FBR and SBP as respondents as well. That petition was dismissed being not maintainable because the petitioner/complainant was not considered as an aggrieved party.

“The same complainant has again lodged a complaint with NAB (it is assumed that the allegations remain the same as mentioned in the dismissed writ petition), copy of which has been requested from NAB authorities but not shared till date,” sources privy to the hotel’s acquisition told Daily Pakistan on Monday.

According to the sources, the five-star hotel was purchased in the last quarter of the calendar year 2010 through a holding company in Singapore namely Residentia Holdings PTE Limited. For the foregoing purpose the world’s top professional accountancy firm namely, PricewaterhouseCoopers, United Kingdom (PWC) was engaged. In the light of the valuation conducted by PWC, the consideration for acquiring this hotel was mutually agreed between the parties at approximately £32 million, the sources added.

They further highlighted that this amount was raised by Mr. Mansha’s two sons and daughter-in-law (wife of third son) through a mix of debt and equity, but largely through debt in the name of Residentia Holdings PTE Limited (RHPL), Singapore (100% owned by the aforementioned 3 individuals).

An amount of £5 million was contributed during the year ended June 30, 2011 by these three individuals as equity through their own sources and the remaining £27 million was raised by way of borrowing by RHPL from outside Pakistan. The loans have been settled and, for this, the three shareholders have injected further equity. Total equity represents foreign currency lawfully sent abroad from Pakistan through banking channels out of tax paid income and has throughout been declared in tax returns filed with FBR.

The subject transaction has been undertaken in accordance with the applicable legal framework and appropriate disclosures have been duly made by the acquirers in their independent tax returns/wealth statements in accordance with the applicable laws.

Sources assert that the factual position, already on record, negates both of the allegations, that is as to the consideration settled for this transaction, as well as the involvement of Mr. Mansha and his children in alleged money laundering.

Still, NAB issued the tycoon two call up notices despite the fact “he has personally no right, title or interest of any nature in St. James Hotel and Club UK nor ever had or held any such right, title or interest”.

Sources said Mr. Mansha did not only elaborate upon the entire transaction in great detail in his March 14th statement, but also responded positively to all NAB queries and concerns to their satisfaction. He was informed that he might be summoned again if further information was required.

However, a private TV channel put all the focus on the non-appearance of Mian Hassan Mansha and Mian Umar Mansha in the interrogation session.

On the other hand, sources told Daily Pakistan that Mr. Mansha’s sons had received call up notices from NAB to which they responded lastly on 29th September 2018 requesting for the provision of copy of the complaint. Copies of their replies dated 29th September 2018 were also endorsed to Chairman NAB and the Prosecutor General NAB, according to the sources.

Mian Mansha and his Nishat Group has in the past filed claims of damages in a UK court against ARY Network inter alia for spreading malicious and unfounded allegations with regards to money laundering. The court decided the defamation claim in their favour vide its verdict dated 8th June 2018, by awarding damages of £75,000 and legal costs of £200,000.

Now they have urged the media and NAB to show restraint from highlighting such matters unless these are concluded and proved, “as there is no effective expedient remedy available to make good the financial and reputational losses one may sustain due to unfounded, malicious and defamatory media campaigns”.

“To ensure fair proceedings, particularly related to complex financial and legal matters, NAB should allow the alleged accused persons to be represented and assisted by their legal counsels and other internal/external experts relating to the nature of allegations from the initial stage,” they insisted.

Last week, the chief executive of Nishat Group was interrogated by a three-member team of National Accountability Bureau (NAB) for 45 minutes where he was questioned for the purchase of London’s Saint James Hotel and Club.

The St James's Hotel and Club is a hotel at 7-8, Park Place, St. James's, London SW1A 1LP. The hotel is part of the Lahore-based Nishat Group since it was bought in November 2010. The hotel has fifty-six rooms and twelve suites, many of which have their own terraces, plus a penthouse with a party deck for sixty people.

Moved by a complaint, the anti-graft watchdog last Thursday (March 14) recorded Mansha’s personal statement against the allegations of illegally transferring funds to United Kingdom (UK) from Pakistan.

It has also been revealed that a false and frivolous writ petition WP#358 of 16 earlier was filed with Islamabad High Court by Pakistan Welfare Party through its Chairman Farooq Sulehria (the petitioner/complainant), alleging therein that Mian Mohammad Mansha’s family acquired the St. James Hotel and Club, London in 2010 for total consideration of £60 million, equivalent to PKR 9 billion.

It was alleged in the petition that the funds used for the purchase of this Hotel were not legal; hence a charge of money laundering was levelled against Mr. Mansha’s family, impleading NAB, FBR and SBP as respondents as well. That petition was dismissed being not maintainable because the petitioner/complainant was not considered as an aggrieved party.

“The same complainant has again lodged a complaint with NAB (it is assumed that the allegations remain the same as mentioned in the dismissed writ petition), copy of which has been requested from NAB authorities but not shared till date,” sources privy to the hotel’s acquisition told Daily Pakistan on Monday.

According to the sources, the five-star hotel was purchased in the last quarter of the calendar year 2010 through a holding company in Singapore namely Residentia Holdings PTE Limited. For the foregoing purpose the world’s top professional accountancy firm namely, PricewaterhouseCoopers, United Kingdom (PWC) was engaged. In the light of the valuation conducted by PWC, the consideration for acquiring this hotel was mutually agreed between the parties at approximately £32 million, the sources added.

They further highlighted that this amount was raised by Mr. Mansha’s two sons and daughter-in-law (wife of third son) through a mix of debt and equity, but largely through debt in the name of Residentia Holdings PTE Limited (RHPL), Singapore (100% owned by the aforementioned 3 individuals).

An amount of £5 million was contributed during the year ended June 30, 2011 by these three individuals as equity through their own sources and the remaining £27 million was raised by way of borrowing by RHPL from outside Pakistan. The loans have been settled and, for this, the three shareholders have injected further equity. Total equity represents foreign currency lawfully sent abroad from Pakistan through banking channels out of tax paid income and has throughout been declared in tax returns filed with FBR.

The subject transaction has been undertaken in accordance with the applicable legal framework and appropriate disclosures have been duly made by the acquirers in their independent tax returns/wealth statements in accordance with the applicable laws.

Sources assert that the factual position, already on record, negates both of the allegations, that is as to the consideration settled for this transaction, as well as the involvement of Mr. Mansha and his children in alleged money laundering.

Still, NAB issued the tycoon two call up notices despite the fact “he has personally no right, title or interest of any nature in St. James Hotel and Club UK nor ever had or held any such right, title or interest”.

Sources said Mr. Mansha did not only elaborate upon the entire transaction in great detail in his March 14th statement, but also responded positively to all NAB queries and concerns to their satisfaction. He was informed that he might be summoned again if further information was required.

However, a private TV channel put all the focus on the non-appearance of Mian Hassan Mansha and Mian Umar Mansha in the interrogation session.

On the other hand, sources told Daily Pakistan that Mr. Mansha’s sons had received call up notices from NAB to which they responded lastly on 29th September 2018 requesting for the provision of copy of the complaint. Copies of their replies dated 29th September 2018 were also endorsed to Chairman NAB and the Prosecutor General NAB, according to the sources.

Mian Mansha and his Nishat Group has in the past filed claims of damages in a UK court against ARY Network inter alia for spreading malicious and unfounded allegations with regards to money laundering. The court decided the defamation claim in their favour vide its verdict dated 8th June 2018, by awarding damages of £75,000 and legal costs of £200,000.

Now they have urged the media and NAB to show restraint from highlighting such matters unless these are concluded and proved, “as there is no effective expedient remedy available to make good the financial and reputational losses one may sustain due to unfounded, malicious and defamatory media campaigns”.

“To ensure fair proceedings, particularly related to complex financial and legal matters, NAB should allow the alleged accused persons to be represented and assisted by their legal counsels and other internal/external experts relating to the nature of allegations from the initial stage,” they insisted.

Advertisement

-

Is it true that Sony and Tecno have partnered up?

10:06 PM | 25 Apr, 2024 -

Man quits 'toxic job' amid drumbeats

09:35 PM | 25 Apr, 2024 -

Asim Azhar deletes all Instagram posts: Is a surprise in store?

08:56 PM | 25 Apr, 2024 -

TikTok’s future in US uncertain as ban looms

08:48 PM | 25 Apr, 2024 -

PTI-led opposition parties announce schedule of protests in Karachi, ...

08:05 PM | 25 Apr, 2024

Pakistani rupee exchange rate to US dollar, Euro, Pound, Dirham, and Riyal - 25 April 2024 Forex Rates

Pakistani currency remains unchanged against US Dollar and other currencies on April 25, 2024 Monday in open market.

USD to PKR rate today

US dollar was being quoted at 277.5 for buying and 280.5 for selling.

Euro comes down to 294 for buying and 297 for selling while British Pound hovers at 342.5 for buying, and 346 for selling.

UAE Dirham AED was at 75 and Saudi Riyal's new rate was at 73.30.

Today’s currency exchange rates in Pakistan - 25 April 2024

Source: Forex Association of Pakistan. (last update 09:00 AM)

| Currency | Symbol | Buying | Selling |

| US Dollar | USD | 277.5 | 280.5 |

| Euro | EUR | 294 | 297 |

| UK Pound Sterling | GBP | 342.5 | 346 |

| U.A.E Dirham | AED | 75 | 75.8 |

| Saudi Riyal | SAR | 73.30 | 74 |

| Australian Dollar | AUD | 181 | 182.8 |

| Bahrain Dinar | BHD | 740.81 | 748.81 |

| Canadian Dollar | CAD | 201 | 203.2 |

| China Yuan | CNY | 38.45 | 38.85 |

| Danish Krone | DKK | 39.93 | 40.33 |

| Hong Kong Dollar | HKD | 35.55 | 35.9 |

| Indian Rupee | INR | 3.34 | 3.45 |

| Japanese Yen | JPY | 1.86 | 1.94 |

| Kuwaiti Dinar | KWD | 903.61 | 912.61 |

| Malaysian Ringgit | MYR | 58.28 | 58.88 |

| New Zealand Dollar | NZD | 164.22 | 166.22 |

| Norwegians Krone | NOK | 25.46 | 25.76 |

| Omani Riyal | OMR | 723.48 | 731.48 |

| Qatari Riyal | QAR | 76.52 | 77.22 |

| Singapore Dollar | SGD | 204.5 | 206.5 |

| Swedish Korona | SEK | 25.72 | 26.02 |

| Swiss Franc | CHF | 305.43 | 307.93 |

| Thai Bhat | THB | 7.51 | 7.66 |

Advertisement

Lifestyle

Blogs

- Who is the most followed Pakistani actor on Instagram? 09:55 PM | 3 Apr, 2024

- Forbes 2024 List of World's Billionaires is out now: Taylor Swift, ChatGPT founder enter elite ranks 12:12 PM | 3 Apr, 2024

- Pakistan's ranking improves by 7 spots in Transparency International Corruption index 01:52 PM | 30 Jan, 2024

- Pakistan Army ranked among top 10 strongest militaries in the world 01:42 PM | 17 Jan, 2024

- 10 Top Google searches made by Pakistanis in 2024 09:36 PM | 20 Mar, 2024

- Famous People Who Passed Away in 2023 08:35 PM | 26 Dec, 2023

Follow us on Facebook

Follow us on Twitter

Sign up for Newsletter

Copyright ©2024. Reproduction of this website's content without express written permission from 'Daily Pakistan' is strictly prohibited.