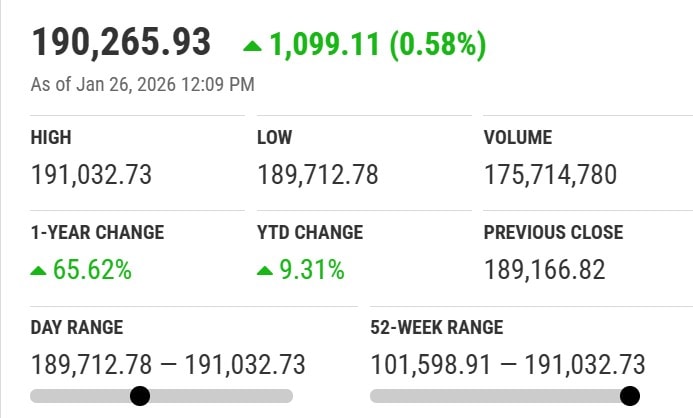

KARACHI – Another historic day at Pakistan Stock Exchange (PSX) as benchmark KSE-100 index soared past 191,000 mark for first time in history, as investors eagerly await Monetary Policy Committee (MPC) meeting today on Monday.

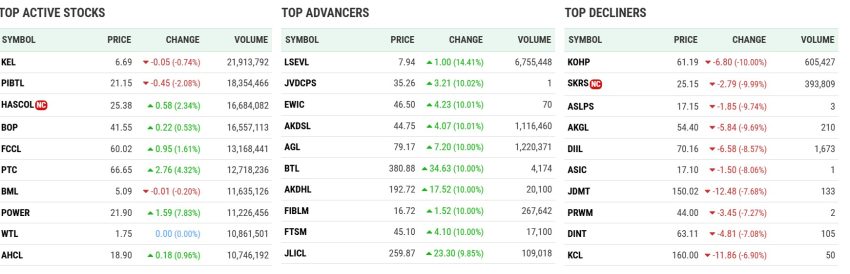

Around noon, KSE-100 index was trading at 190,521.41, climbing 1,354.59 points amid robust demand across automobile assemblers, cement, fertilizer, oil and gas exploration, OMCs, and power generation sectors.

Market watchers remain bullish ahead of the MPC, with Pakistan Kuwait Investment Company (Private) Limited noting that most analysts predict a 50-basis-point rate cut. Momentum is being reinforced by lower secondary market yields, rising remittances, new oil discoveries of 9,500 barrels per day, and defense deals exceeding $13 billion. Easing US-Iran tensions, coupled with growing defense cooperation with Saudi Arabia and Türkiye, are further lifting investor confidence.

Governor SBP Jameel Ahmad is set to brief the media after the MPC decision. Analysts expect a 50–100 bps reduction in the policy rate, following the committee’s surprise 50-bps cut in December 2025, when inflation remained within the 5–7% target range.

On the macro front, Pakistan is unlikely to achieve the IMF’s projected 3.2% GDP growth, with leading economists predicting a more modest 2.5–3%, assuming no major economic shocks occur.

The previous week saw the KSE-100 climb 4,068 points (2.2%) to close at 189,166.83, powered by easing geopolitical tensions, renewed foreign engagement, falling bond yields, and expectations of further monetary easing.

Globally, gold prices shattered records, topping $5,000 per ounce amid dollar weakness and safe-haven buying triggered by unrest in Greenland and Iran. The Japanese yen surged over 1% to 153.99 per dollar after speculation of a potential US-Japan intervention. Markets braced for the Federal Reserve’s upcoming policy meeting, with Japan’s Nikkei down 2%, S&P 500 futures off 0.25%, and European futures down 0.27%.

SBP to announce 2026’s first monetary policy today amid rate cut hopes