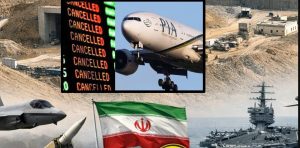

KARACHI – Pakistani Stock market responded by sharply scaling back expectations of near-term policy easing. Panic selling ripped through Pakistan Stock Exchange as intensifying geopolitical tensions and a fresh surge in oil prices triggered a brutal market rout, wiping more than 6,100 points off the benchmark KSE-100 Index in early trade.

By 2:20pm, PSX crashed to 182,248.85, down by 6,131.53 points, as investors rushed for the exits. The sell-off spared no sector. Automobile assemblers, cement producers, commercial banks, fertiliser companies, oil and gas explorers, power generation firms, and refineries were all hammered.

The deteriorating global backdrop reinforced fears that interest rate cuts will be delayed, as policymakers struggle to navigate growing uncertainty. Market nerves were further rattled by disappointing financial results from Fauji Fertilizers Limited, which came in below expectations.

Adding to anxiety, trade bodies raised red flags over proposed India–European Union Free Trade Agreement, cautioning that it could severely undermine Pakistan’s textile and hosiery exports. They warned the deal may leave Pakistan at a structural disadvantage, even with its GSP+ trade privileges with the EU.

The sharp reversal after relatively calm session a day earlier, when Stock Exchange managed modest gain. The selective buying in energy, power generation, and banking stocks helped KSE-100 Index inch up by 177.53 points, or 0.09%, to close at 188,380.39, despite lingering volatility and weak market breadth.