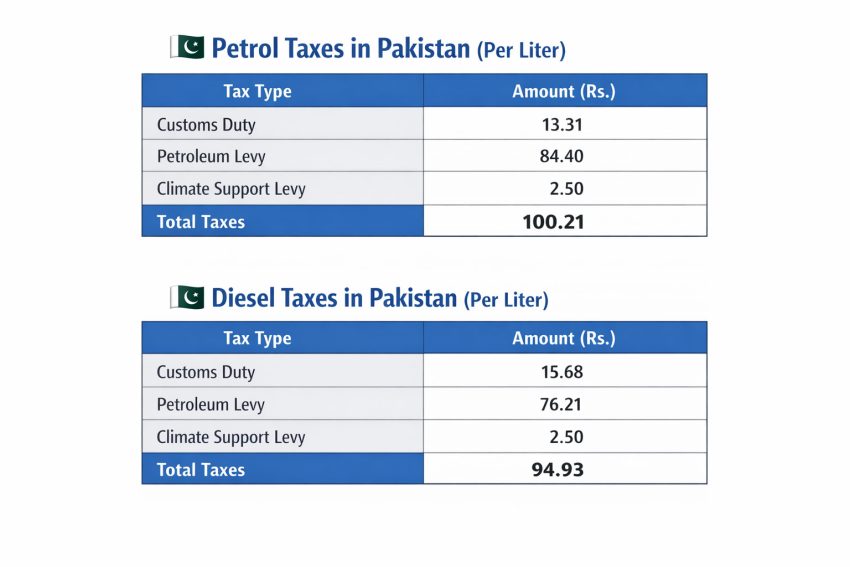

ISLAMABAD – Pakistanis are paying over Rs.100 Tax on Every Liter of Petrol as the hidden burden draining your wallet.

The government is collecting an eye-watering Rs100.21 in taxes on every single liter of petrol, which makes up around 40percent of total price. Diesel isn’t far behind, with Rs. 94.93 per liter charged as taxes, accounting for 34% of its price.

Official documents from the Ministry of Energy expose exactly where this money is going, and the breakdown is nothing short of alarming.

Petrol Taxes in Pakistan

| Tax Type | Amount |

|---|---|

| Customs Duty | 15.68 |

| Petroleum Levy | 76.21 |

| Climate Support Levy | 2.50 |

| Total Taxes | 94.93 |

On top of these taxes, oil marketing companies pocket Rs. 7.87 per liter on both petrol and diesel. Meanwhile, fuel dealers charge an additional Rs. 8.64 per liter, separately on petrol and diesel.

Before your vehicle even moves an inch, a huge chunk of what you pay has already vanished into taxes, levies, company margins, and dealer commissions. For millions of citizens struggling with inflation, these figures reveal a harsh truth: fuel prices are being driven less by oil costs and more by relentless taxation.

Petrol Price in Pakistan increased by Rs5, Diesel by Rs7.32 per Litre for February