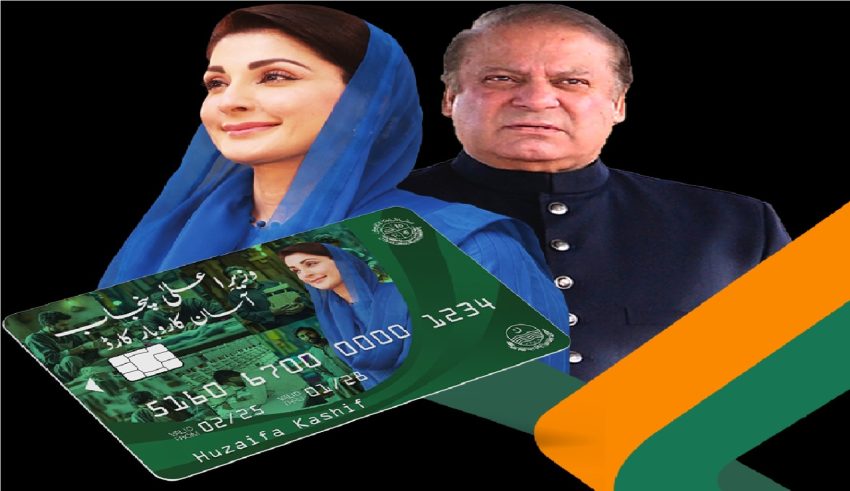

LAHORE – Punjab Chief Minister Maryam Nawaz has launched CM Punjab Karobar Card 2025 to boost small medium enterprises and startups in the province.

The scheme offers interest-free loans of up to Rs1 million through a digital SME card. It supports small entrepreneurs in Punjab to grow and sustain their businesses, ensuring structured through Digital Channels (e.g. Mobile App, POS etc.) and transparent utilization of funds.

The government offers the interest free loan for tenure of three years while the loan includes revolving credit facility for 12 months.

The borrower will repay the loan in 24 equal monthly installments after the first year with grace period of 3 months from card issuance.

Usage of CM Punjab Karobar Card

Vendor and supplier payments

Utility bills, government fees, and taxes

Cash withdrawal (up to 25% of the limit) for miscellaneous business purposes

Digital transactions through POS and mobile app

End-User Interest Rate: 0%

Eligibility Criteria

All Small Entrepreneurs (SEs) in Punjab

Age: 21 to 57 years

Pakistani National, resident in Punjab

Valid CNIC and mobile number registered in the applicant’s name

Existing or prospective business located in Punjab

Satisfactory credit and psychometric assessment

Only one application per individual and business

Clean credit history with no overdue loans

Where to Apply?

Applications can be submitted digitally via PITB portal. There will be non-refundable processing fee of Rs500.

Digital verification of CNIC, creditworthiness and business premises conducted by authorized agencies.

Charges / Fees for Karobar Card

Annual Card Fee: PKR 25,000 + FED to be recovered from obligor’s approved limit

Additional Charges: Life assurance, card issuance and delivery charges covered by the scheme

In case of late payment of installments, late Payment Charges would be recovered as per Bank’s Policy / Schedule of Charges