KARACHI – Pakistan reportedly lost around $600 million to illegal cryptocurrency investments. Exchange Companies Association chief makes startling revelations that while banks purchased $4 billion from exchange companies last year, this dropped to $3 billion this year.

The South Asian nation, which is already facing a shocking new threat to its fragile dollar reserves, an estimated $600 million disappeared into illegal cryptocurrency transactions, severely cutting flow of dollars into country’s banking system. Citizens are reportedly buying dollars from exchange companies only to funnel them into crypto markets through unlawful channels.

Malik Bostan revealed that during first ten months of last year, Pakistani banks purchased $4 billion from exchange companies. This year, it fell to $3 billion. The missing billion vanished into cryptocurrencies.

The scheme is reportedly simple but damaging. Dollars bought from exchange companies are deposited into foreign currency (FCY) accounts, withdrawn, and then invested in crypto through illegal means. Between January and October 2025, Pakistanis kept $400 million in foreign currency, accounts, but staggering $600 million simply disappeared without trace.

To deal with this, State Bank ordered banks and exchange companies to stop handing out cash dollars. All purchases must now be directly transferred into FCY accounts. Yet, exchange companies admit that these deposits are still being siphoned off to crypto investments.

Dollar sales to banks plunged despite tightened border controls with Afghanistan and Iran. Data shows exchange companies sold $280 million in July 2025; $163 million in August; $186 million in September, and $244 million in October. Total sales from July to October fell 23 percent, from $1.139 billion in 2024 to just $873 million this year.

On the other hand, commercial banks’ dollar holdings increased from $4.18 billion in January to $4.625 billion, a $425 million jump, but analysts warn this may not offset the growing crypto-driven drain.

Pakistan has struggled with dollar shortages for years and came dangerously close to default in 2023. After an IMF bailout, authorities tightened import restrictions and cracked down on illegal trading and smuggling. While those efforts largely worked, the explosive rise of cryptocurrency investments now threatens to undo progress.

Lately, Pakistani government is racing to secure international and Chinese funding through new bonds and Panda Bonds. Currently, State Bank’s foreign reserves sit at $14.551 billion, with expectations to hit $17 billion by FY26. Boosted by high remittance inflows and an anticipated $1.2 billion from the IMF, authorities hope to stay afloat, but with $600 million potentially flowing out through crypto, the warning signs are flashing red.

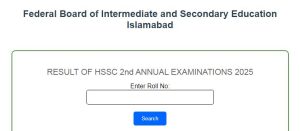

Lost Money to Crypto Fraud? Here’s where Pakistani investors can file complaints