MANDI BAHAUDDIN – Pakistan Peoples Party’s (PPP) struggle to make its way in Punjab does not seem to be going anywhere as its members, who are upset with the party leadership, seem to be defecting to Pakistan Tehreek-i-Insaf (PTI).

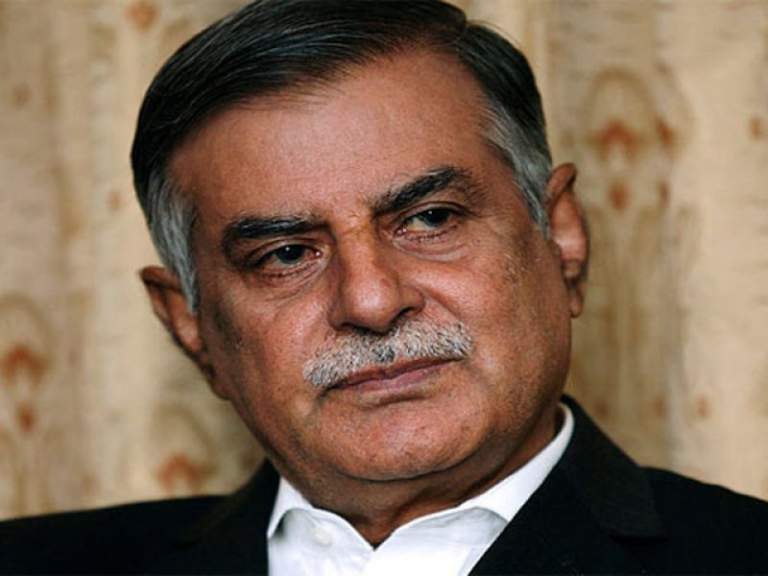

In the latest development, former minister of PPP Nazar Muhammad Gondal from Mandi Bahauddin, Punjab has announced his decision to leave the party.

Nazar is known for his alleged corruption while serving as the Federal Minister. He also got his brother Zafar Gondal appointed as Chairman EOBI and, during his tenure, EOBI faced huge losses. He allegedly bought properties without prior approval, at double or more the original market price. He also allegedly bought 18 properties from PTI Leader Aleem Khan at an exorbitant rate.

The FIA had initiated investigations against him for causing a Rs44 billion loss to the national exchequer through underhand land deals. Gondal allegedly violated the investment rules of EOBI to buy lands in Lahore, Islamabad and Karachi at exorbitant prices. The official record, a copy made available to the EIC, suggested that the EOBI board vehemently opposed the controversial land deals with select sellers and property tycoons.

One of the many underhand deals led by Gondal included EOBI purchasing a plaza in Islamabad from a man named Abdul Qayyum at an extremely high price without a third-party evaluation. Qayyum had later told FIA investigators that he paid a kickback to Gondal and other senior officials of EOBI.

In accordance with section 18 of the EOB Act 1976, the institution may, from time to time invest any money which is not immediately required for expenses under this act and may reinvest or realize investment.

The Board of Trustees appoints different Committees under rule 6(i) of EOBI (Board of Trustee) Rules, 1977. At present, the following Committees of the Board are functioning:

1 Investment Committee

2 Human Resource Committee

3 Audit Committee

The mandate of these Committees is to examine any matter referred to them and submit its recommendations to the Board for its consideration and approval. The Investment Committee considers parking of surplus funds in Treasury Bills, and Term Deposit Receipts (TDR) in different banks, investment in equity market and investment proposals in real estate. However, under rule 6 (g) of the EOBI (Board of Trustees) Rules 1977, (Annex II) investment of more than 50 Lac in real estate requires the prior approval of the Board of Trustees of EOBI.

The Institution has a separate Investment Department headed by Investment Advisor/DG (Investment) which prepares different proposals for investment in Government Securities and Real Estate, ensures technical soundness of such proposals and presents them before the Investment Committee. The composition of Investment Committee is as under:

1.Mr. Iqbal Dawood Pakwala, Employer’s representative, Sindh (Convener)

2.Malik Imtiaz Mehfooz, Employees Representative, Balochistan (Member)

3.Chairman EOBI, Member

4.Investment Advisor/DG (Investment)-EOBI (Member)

5.Financial Advisor/ DG (F&A)-EOBI (Member)

6.Joint Secretary OR Representative of OP & HRD (Member)

7Deputy Director General (Investment) (Member)/Secretary

Investment Committee examines bids from different banks for parking of surplus funds of EOBI in T-Bills and TDRs. It also examines the proposals for investment in the equity market. The Committee also examines proposals for making investment in real estate up to Rs.50 Lac and makes recommendation for making investment in real estate for more than Rs. 50 lac.

Rule 3 of the EOB (Investment) Rules 1979 prescribe the permissible investment such as in government securities, Government Guaranteed Securities, shares and immovable properties etc whereas rule 4 of these rules prescribed the limits of investment in each avenue. However, it was established practice before 2010 to invest only in government-owned real estate schemes in order to save the trust money of the poor workers. Thereafter, the management of EOBI started investing in private property as well in violation of established practice.

Several cases were registered against the management of EOBI including Zafar Iqbal Gondal (Chairman EOBI) and the sellers of various properties for buying these properties at highly exorbitant rates.

Gondal was Chairman, Member Board of Trustees and Member Investment Committee. He is the main accused person in all the cases registered as he was not only the chairman but also a member of Investment Committees and Board of Trustees who made illegal investments in private properties in violation of previous practice causing colossal loss of billions of rupees to EOBI.

At present, challans have been submitted in the Court of Special judge (Central) Lahore while post-arrest bail petitions of Zafar Iqbal Gondal Ex-Chairman EOBI in case FIR Nos. 51-57/2013 PS FIA ACC (EOBI Scam) Lahore were heard on 06.10.2016 before Honorable Lahore High Court Lahore. After hearing detailed arguments the Honorable Court reserved the judgment.

On 13.10.2016 the Honorable Court announced the judgment, accepting the bail petitions of accused (Zafar Iqbal Gondal, Ex-Chairman EOBI) on statutory grounds. Former chairman Employees’ Oldage Benefit Institution (EOBI) Zafar Gondal, a brother of former federal minister Nazar Mohammad Gondal, had recruited over 300 employees in EOBI and inflicted over Rs 600 million losses to the national exchequer. The next date of hearing of the main case before the Supreme Court of Pakistan is 07.06.2017.