KARACHI – As the year 2024 begins, JS Bank, one of the fastest-growing banks in Pakistan, reflects on its journey of progress and growth to provide the best-in-class services to its customers.

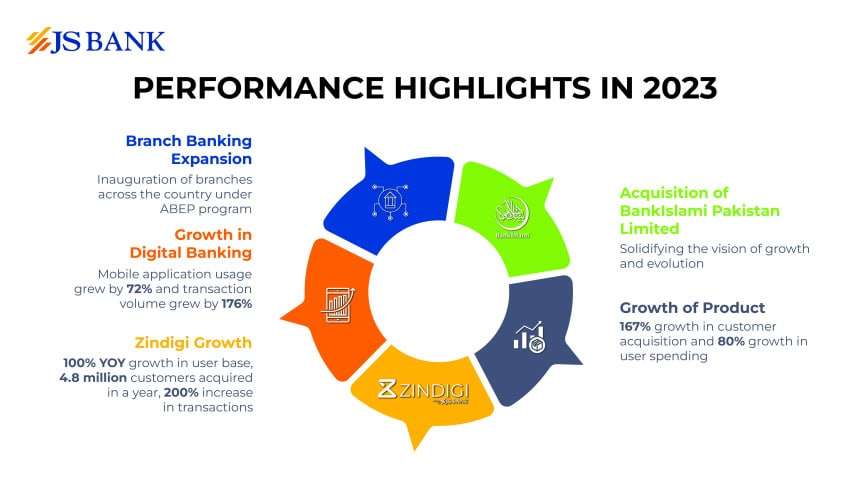

In a year of memorable highlights, acquiring BankIslami was a significant milestone for JS Bank, reiterating its commitment to growth and evolution. Together, both banks will continue to operate independently in their respective domains and remain steadfast in their mission to provide best-in-class financial services to their customers.

JS Bank also remained committed to expanding its footprint nationwide by inaugurating new state-of-the-art branches to improve customer outreach. Under JSBL’s Annual Bank Expansion Plan (ABEP), several chapters in the rural and urban areas were inaugurated, including Hala, Chawharmal, and Gambat branches in Sindh, Samundri branch in Faisalabad, Gujar Khan branch in Rawalpindi, and several others.

With a focus on future-proofing the Bank, JSBL went beyond the brick-and-mortar branches and made strides in its digital ends to meet the customers’ evolving needs, driving digital adoption and financial inclusion. In 2023, JS Bank’s mobile application usage grew by 72%, resulting in a 176% increase in the transaction volume compared to the previous year. The Bank also witnessed 148% growth in utilising JS BOT, a personal WhatsApp banking assistant, with over 2.6 million hits for critical digital services.

Zindigi, JS Bank’s fintech offering, witnessed 100% YOY growth in its user base in 2023, accumulating 4.8 million customers, with a consistent 200% increase in transactions and a 50% increase in the value of trades. The growth resulted from continuous innovative product offerings, including digital payments, loans, stocks, mutual funds, and a premium debit card proposition. Zindigi became a leading Banking as a Service (BaaS) and Open Banking Solution Provider.

Zindigi also extended its impact beyond the financial space and empowered young entrepreneurs by launching the Zindigi Prize, a year-long social entrepreneurship program with 5000 start-ups in more than 130 university campuses nationwide.

Considering the market needs for credit and immediate funds, JS Bank revamped its offerings, including cashback and other incentives, marking a growth of 167% in customer acquisition and an 80% rise in user spending.

JS Bank also became a trusted partner to provide corporate and employee banking solutions to some of the leading businesses in the country, including Daraz, State Life Insurance, Attock Petroleum, Nestle, and Oil & Gas Development Company (OGDCL).