UBL has been one of the leading advocates of the government backed ‘Mera Pakistan Mera Ghar’ low-cost housing finance scheme since its inception. To further enhance the Bank’s promotion and extension of this facility, UBL signed an agreement with Akhuwat Islamic Microfinance (AIM) in order to offer exclusive Housing Finance Solutions to the customers of Akhuwat. Furthermore, UBL will provide Housing Finance solutions on Low Cost Housing variants under Islamic Financing mode and will offer exclusive arrangements to the customers of Akhuwat.

AIM, a not-for-profit organization, has in-depth expertise of serving the under-privileged through favourable financial schemes.Through this agreement, AIM will coordinate with UBL in identification of the individuals who desire to obtain facility under the scheme. Both parties will explore viable business opportunities under the scheme and work towards extending the facility to the maximum number of deserving candidates.

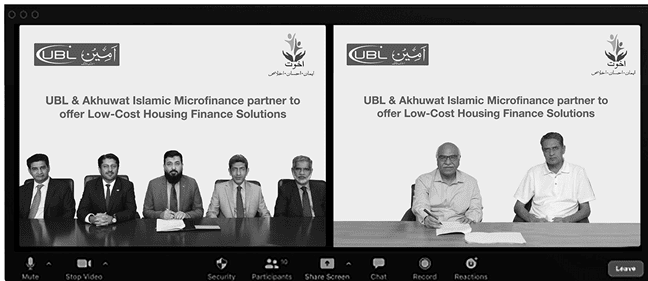

The online agreement signing ceremony was held on Tuesday, May 25, 2021. Mr. Shazad G Dada, President & CEO UBL, along with Mr. Zia Ijaz, Group Executive, Branch Banking & International, Mr. Tanveer Farhan Mahmood, Head Islamic Banking and other senior executives were present on behalf of UBL. AIM was represented by Dr. Muhammad Amjad Saqib, Executive Director along with other senior officials.

Dr. Muhammad Amjad Saqib, Executive Director, AIM, said “It is indeed heartening to see that large banks like UBL are working wholeheartedly to bring about a positive change in the society. We look forward to working with UBL on this noble project to bring affordable and convenient housing solutions for the deserving masses of Pakistan.”

“The ‘Mera Pakistan Mera Ghar’ low-cost housing finance scheme is an integral project with strong backing from the Government of Pakistan. With the extensive hands-on expertise of Akhuwat on our side, UBL will be further able to provide streamlined and more focused low-cost housing finance solutions to deserving candidates across the country”, said Mr. Shazad G Dada, President & CEO UBL at the occasion.