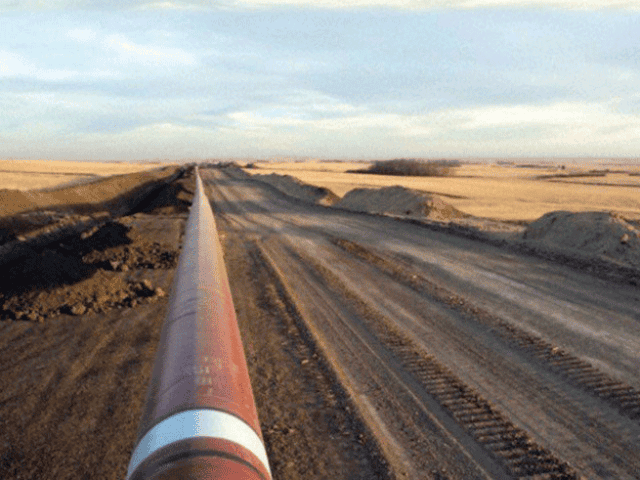

They are planning to develop some Gas Infrastructure in Pakistan but they have decided not to pay for it from their own pocket (not pockets because they have a big mutual pocket). Hence they passed the Gas Infrastructure Development Cess Act, 2015. It is not the first time when they have coined this law, they have been doing it for last few years.

The GIDC Act 2015, in section 3, says that a cess named the Gas Infrastructure Development Cess shall be collected from the gas consumers other than the domestic consumers at the rates per MMBTU mentioned in the second schedule of the Act 2015. Section 4 of the Act describes the utilisation of the Cess that the cess so collected shall be used by the federal government for or in connection with the infrastructure development of Iran-Pakistan Pipeline Project, Turkmenistan-Afghanistan-Pakistan-India (TAPI) Pipeline Project, LNG or other ancillary projects. The rates mentioned in the second schedule of the Act 2015 are as (Rs/MMBTU): Fertilizer@300, Fertilizer-Fuel@150, Captive Power@200, Industrial@100, KESC/GENCO@100, IPPs@100, CNG Region1@263.5, and CNG Region2@200.

The GIDC Act 2011 was enacted for the same purpose, bringing about a bulk of litigation from almost every industry in Pakistan. The honourable High Courts kept the gas companies from collecting the GIDC from the petitioners, as the act had been launched through a money bill which is not warranted by law, and finally it was ruled to be illegal by the August Supreme court of Pakistan. But they have a lot of ways and bulk of powers, so the GIDC Ordinance 2014 was passed by the president. This Ordinance was passed despite the fact that there was no deadly urgent need to pass it while the national assembly was in session. Moreover it was included in the Ordinance 2014 for the first time that the GIDC collected from the consumers in pursuance of the Act 2011 shall be considered to have been levied and collected properly despite anything contrary contained in any decree, judgment or order of the court (the same has been framed in the Act 2015 as well). This ordinance was brought under judicial review, and honourable high courts granted a stay against it as well, and the case has not yet been decided. Now the National Assembly has passed the GIDC Act 2015 in order to impose a further GIDC on the industry.

These are indeed huge amounts and will add a lot of burden onto the smooth running of the business which is a fundamental right ensured by the Constitution of the Islamic Republic of Pakistan. The industry of Pakistan is already feeling chill winds due to the energy crisis. Will it be justified to put such a burden on the sinking industry? The industry is the backbone of an economy and they are trying to break their own backbone.

The GIDC Act comes with some legal and factual complications which need to be clarified. Some of them are the followings:

- GIDC is being imposed mainly to finance the Gas Pipeline projects. While these projects are still under a lot of complications. Can GIDC be charged while the projects have not yet started and are not in a clear form? And till what time shall the GIDC be collected? Will the collection be stopped when the said projects have completed?

- Internationally, this is not how the governments finance to build infrastructure. There are other practical methods which the states use (such as issuing tax-free bonds). Is collection of huge amounts to build an upcoming infrastructure justified?

- Just as TOLL TAX is imposed on the users of a road after the completion of the road, and not during its construction, similarly how can GIDC be imposed on the gas consumers before completion of the Gas Pipeline projects?

- Provision of basic necessities is one of the foremost duties of a state. There is no doubt that gas is a basic necessity for industries and gas consumers generally. Similarly, electricity is also a basic necessity and should be provided to every citizen of Pakistan. If governments plan to provide electricity to a village of a hundred houses, and the presumptive cost of infrastructure is 20 million, will it be justified asking every house to pay 2 lakhs for erecting the infrastructure?

- The government provides a rationale behind the GIDC that the gas consumers who are paying it will be the beneficiaries of the Pipeline Projects. During completion of these projects, every industry will have paid millions of rupees as GIDC, but will they be refunded this GIDC if they have closed their business when these projects have been completed because they will not be the beneficiaries in such situation.

- The flow of cash will disturb due to GIDC which will eventually become a hurdle in the smooth running of business. While it will be against the fundamental rights provided by the Constitution of Pakistan.

- The GIDC Act 2011 was ruled to be illegal by the August Supreme Court of Pakistan while the section 8 of GIDC Act 2015 says that the GIDC charged and collected from the Gas Consumers under the GIDC Act 2011 or GIDC Act 2015 shall be deemed to have been validly charged, notwithstanding anything contrary contained in any judgment, decree, or order of any court. Is it justified to put such a clause in a law? Does it not amount to bypassing the legacy of the honourable courts?

- The 2nd proviso of the subsection 2 of section 8 of the GIDC Act 2015 provides that the GIDC under the GIDC Act 2011 and GIDC Ordinance 2014, if not already collected from the industrial consumers shall not be collected from them. But it does not clarify as to whether the GIDC collected from the industrial consumers under said laws shall be refunded to them or not.

- If the previous GIDC, as mentioned above, is not to be collected from the industrial consumers, is it not a discrimination against those from whom it will be charged? And what is the rationale behind not collecting the previous GIDC from the industrial consumers if the same had not been collected already?

GIDC, since the commencement of the GIDC Act 2011, shall be collected from the consumers other than the industrial consumers, which means that the Captive Power consumer shall be exempt from paying the GIDC under the GIDC Act 2011 but not under GIDC Act 2014. The reason being there was no separate entry in schedule 2 of the GIDC Act 2011 for Captive Power but this entry was made in the GIDC Act 2015. Moreover, there is still a grave chance that the gas companies will start demanding GIDC from the Captive Power consumers even under the GIDC Act 2011 by taking advantage of the ambiguity in the GIDC Act 2015. However, the industrial consumers are not at all exempt from paying GIDC after the commencement of the GIDC Act 2015.

Now, to cess or not to cess is the question. But to cess is what they will, because they can.