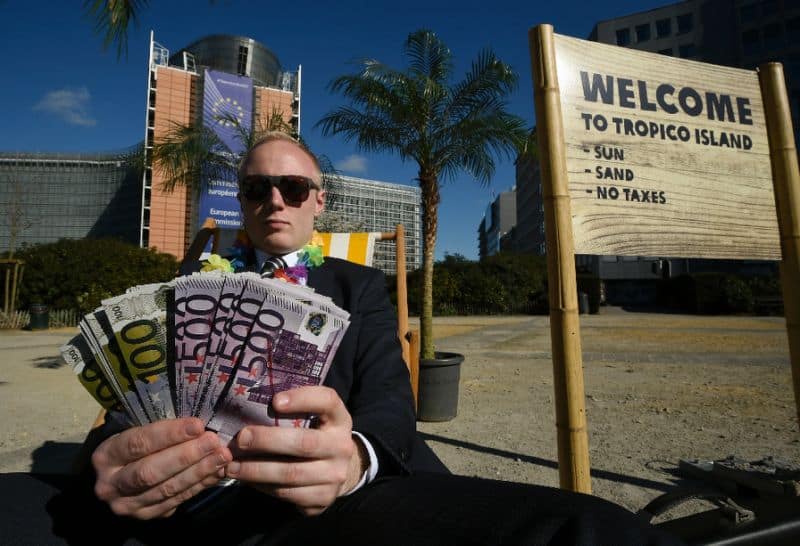

WASHINGTON (APP) – Anonymously owned shell companies, against which the G20 economic powers pledged action Friday, amount to a global black hole that legally puts trillions of dollars out of tax authorities’ reach.

The “Panama Papers,” leaked two weeks ago from the Mossack Fonseca law firm, which helps set up such companies, opened a window into that world.

The documents show how thousands and thousands of the mailbox business fronts exist worldwide, most often in tax havens like Panama, the British Virgin Islands and the Cayman Islands, enabling untraceable owners to stash assets, legal or illegal, offshore.

Often encased by other shell entities like Russian nesting dolls, their existence represents a gaping hole in the international effort to combat tax evasion launched in 2009, which forced banks around the world to share account holders’ data with their home tax agencies.

The business of providing secrecy through shell companies isn’t confined to sunny Caribbean or Pacific islands. In the United States, a number of individual states such as Delaware and Wyoming are hubs for shell company registration.

Their promise of secrecy has made the United States an increasingly popular destination for foreigners wanting to hide assets, legal or illicit.

Russia’s notorious arms trader Viktor Bout deployed shell companies around the world to hide his activities, including in the United States.

Britain’s Jersey and Guernsey islands are also popular tax havens. In a recent case, anonymous companies set up in Jersey enabled a bank affiliated with the Iranian government and restricted by US sanctions to control a Manhattan skyscraper.

“They are designed for concealment and so are as useful for getting around sanctions as they are for tax avoidance or money laundering,” said Pascal Saint-Amans, head of the Organization for Economic Cooperation and Development’s unit fighting tax havens.

The G20’s new commitment to opening up that black hole came out of a push this week by France, Germany, Britain, Italy and Spain, which said they would take the lead in establishing a registry of shell company owners’ identities, with aims to expand it worldwide.

“The recent extensive leaks from Panama show the critical importance of the fight against tax evasion, aggressive tax planning and money laundering,” the five said.

“The current events show that identifying the ultimate beneficial owner behind corporate structures is key to fighting tax evasion, money laundering and illicit finance effectively,” German Finance Minister Wolfgang Schaeuble said.