Discover how the Pakistani startup MYTM, in collaboration with Zindigi (JS Bank) and Mastercard, is revolutionizing Hajj and Umrah with the launch of the cashless Sullis Hajj Card, enhancing convenience and security for pilgrims.

Introduction

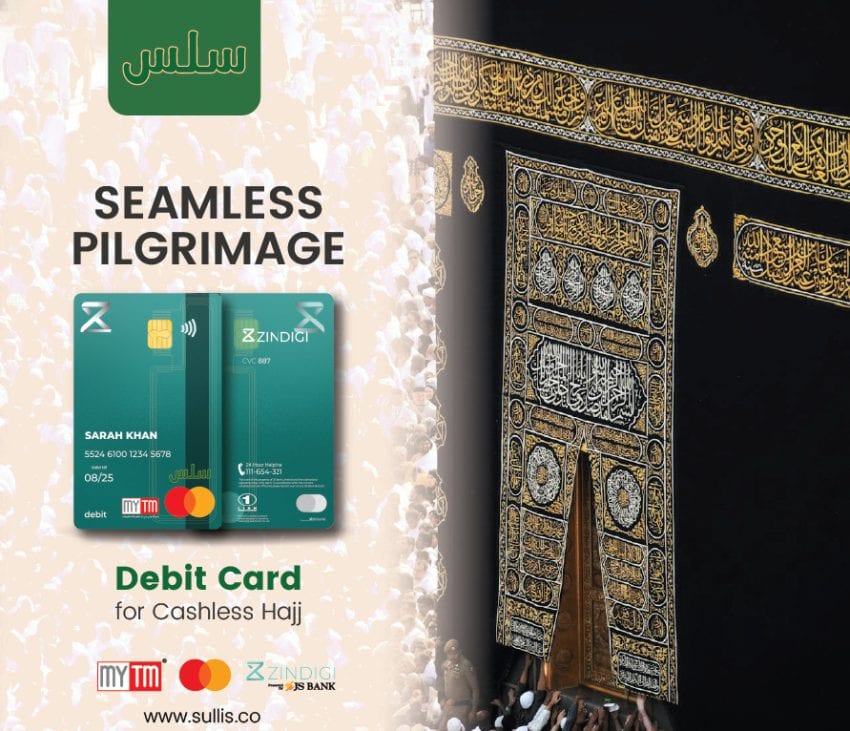

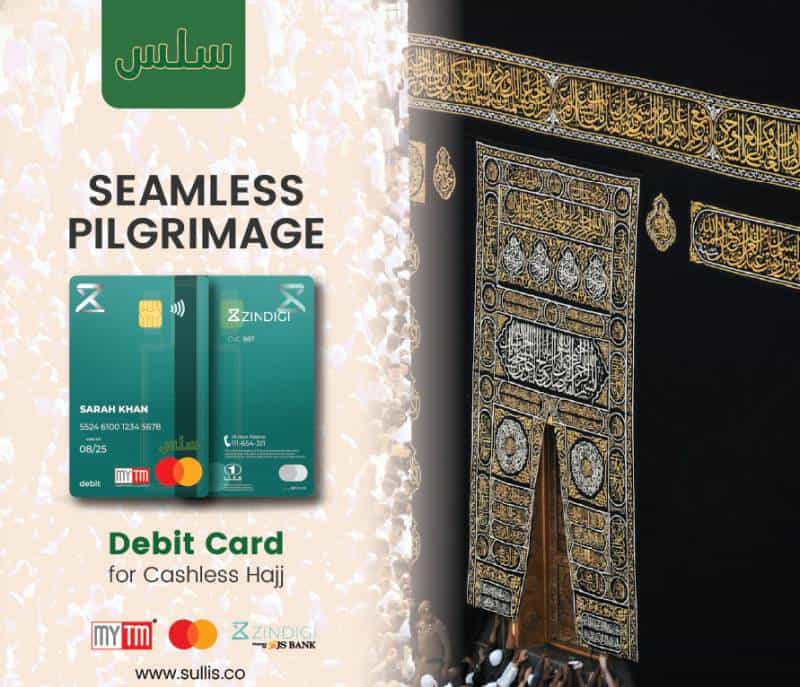

In an unprecedented collaboration, Pakistani homegrown startup MYTM has partnered with JS Bank’s Zindigi and Mastercard to introduce the Sullis Hajj Card. Officially launched on May 15, 2024, this revolutionary financial product aims to provide pilgrims with a seamless, secure, and cashless experience during their spiritual journeys in the Kingdom of Saudi Arabia. This initiative closely aligns with Saudi Arabia’s Vision 2030, which focuses on digitizing religious tourism and enhancing financial inclusion.

What is the Sullis Hajj Card?

The Sullis Hajj Card is a proprietary financial product developed by MYTM, explicitly tailored for pilgrims undertaking Hajj and Umrah. This card allows users to manage their expenses without carrying physical cash, enhancing convenience and security.

Collaboration and Support

The Sullis Hajj Card results from a strategic collaboration between MYTM, Zindigi (a digital banking service by JS Bank), and Mastercard. This partnership aims to provide pilgrims with a fully integrated digital experience, streamlining transactions and eliminating the need for physical cash.

Launch Event Highlights

The launch event on May 6, 2024, marked a significant milestone, attended by dignitaries from Pakistan and Saudi Arabia. His Excellency Mr. Rizwan Saeed Sheikh, Additional Secretary for the Middle East region at the Ministry of Foreign Affairs of Pakistan, and Mr. Adel Almomin, CEO of Finmal and Board Member of Tanmeya Capital, graced the occasion.

Vision 2030 and Digital Transformation

Saudi Vision 2030 is a comprehensive plan to diversify the economy and reduce dependence on oil by developing sectors such as tourism. The Sullis Hajj Card perfectly aligns with this vision, promoting the digitization of religious tourism and enhancing the overall experience for millions of pilgrims.

Key Benefits of the Sullis Hajj Card

Enhanced Security

By eliminating the need to carry cash, the Sullis Hajj Card significantly reduces the risk of theft and loss, providing pilgrims with peace of mind during their spiritual journey.

Convenience

Pilgrims can manage their expenses effortlessly with the Sullis Hajj Card. The card supports multiple currencies, making transactions smooth and hassle-free across various vendors in Saudi Arabia.

Financial Inclusion

This initiative is a step towards greater financial inclusion, enabling even those without traditional bank accounts to participate in the digital economy and manage their finances effectively.

Statements from Key Figures

Rizwan Saeed Sheikh emphasized the project’s role in enhancing financial inclusion and supporting the national financial inclusion strategy. He highlighted Pakistan’s potential, with its large, young population, to lead in digital transformation.

Dr. Zain Farooq, CEO of MYTM Pakistan, expressed pride in launching a product that facilitates a fully integrated digital experience for pilgrims. He reiterated the commitment to innovation and supporting Muslims worldwide with advanced technological solutions.

Jawad Mahmood, CEO of MYTM Saudi Arabia and Sullis, highlighted the collaboration’s significance in promoting a convenient and hassle-free experience for pilgrims and enhancing the spiritual journey with state-of-the-art financial solutions.

Rao Umer, Chief Business Officer at Zindigi, noted the partnership’s goal to simplify the spiritual journey by minimizing the need for cash and enhancing convenience.

Arslan Khan, Vice President Country Manager at Mastercard, emphasized the company’s dedication to improving the experience of pilgrims and supporting initiatives that promote religious tourism.

How to Apply for the Sullis Hajj Card

Pilgrims can apply for the Sullis Hajj Card through the MyTM App or the official websites www.mytm.co and www.sullis.co. Applications are also available through a network of travel agents listed on these websites.

Frequently Asked Questions

What is the Sullis Hajj Card?

The Sullis Hajj Card is a cashless payment solution designed for pilgrims to manage their expenses during Hajj and Umrah without carrying physical cash.

Who can apply for the Sullis Hajj Card?

Any pilgrim planning to perform Hajj or Umrah can apply for the card through the MyTM App, the official websites, or authorized travel agents.

Is the Sullis Hajj Card secure?

The card has advanced security features to protect users’ financial transactions and personal information.

Can the Sullis Hajj Card be used internationally?

The card supports multiple currencies, making it convenient for international use.

How does the Sullis Hajj Card align with Vision 2030?

The card supports Saudi Arabia’s Vision 2030 by promoting the digitization of religious tourism and enhancing the overall pilgrimage experience.

What are the benefits of using the Sullis Hajj Card?

The card offers enhanced security and convenience and supports financial inclusion by providing a cashless solution for pilgrims.

Conclusion

The launch of the Sullis Hajj Card marks a significant milestone in digitising religious tourism. By providing a secure, convenient, and cashless solution, MYTM, in collaboration with Zindigi and Mastercard, is revolutionizing the Hajj and Umrah experience. This innovative product aligns with Saudi Arabia’s Vision 2030 and underscores Pakistan’s potential to lead in digital transformation and financial inclusion.