Global solar markets are entering a critical turning point, and buyers who delay procurement may face both higher costs and longer project timelines. With China expected to cancel export rebates entirely, polysilicon costs on the rise, and freight rates temporarily at a low, analysts warn that the current window to secure modules could close quickly, ushering in sharp price hikes in 2026.

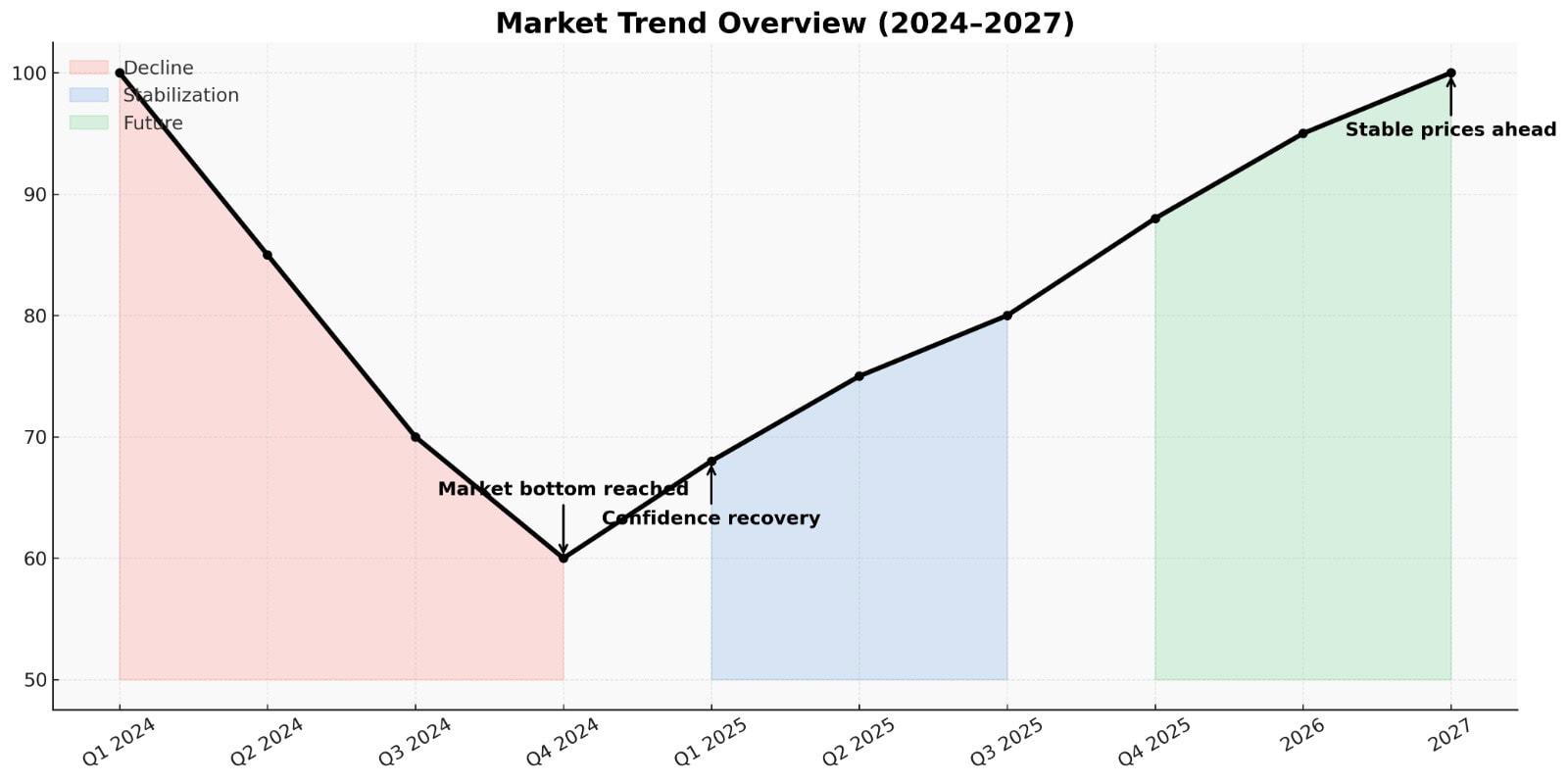

For years, solar buyers enjoyed what many called a “buyer’s market,” with stable pricing and shorter lead times. But as demand outpaces supply, the market has shifted. The Global Spot Index already signals an upward trend, echoing past volatility: between Q2 2020 and Q2 2021, module prices surged by 20% in Europe and 18.5% in the United States. Analysts now forecast that a similar, potentially sharper cycle could repeat, with global module prices expected to rise by 8–12% in early 2026.

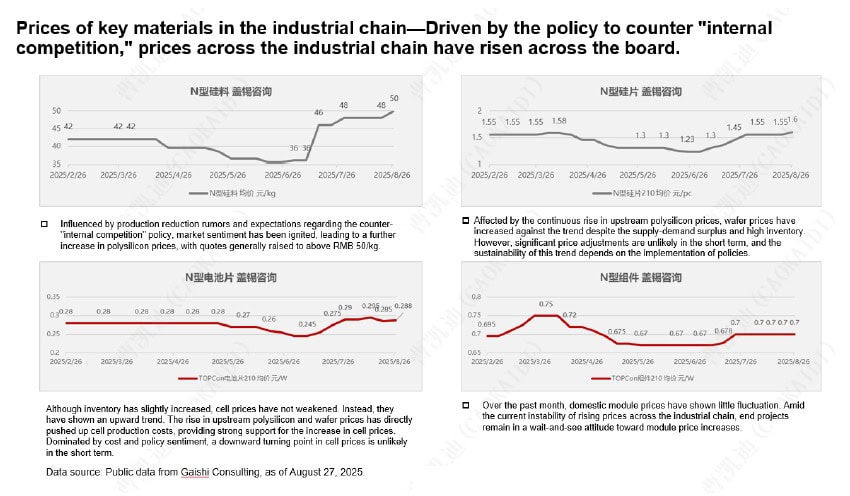

At the heart of the issue is polysilicon scarcity. Despite new capacity under development, existing facilities are running at full tilt. Every $1/kg increase in polysilicon translates into a 2.5–3.5% rise in module costs, a trend already visible in current pricing.

Meanwhile, the prices of auxiliary materials are adding pressure. Glass has doubled in cost, EVA is up by 40%, and critical inputs like silver paste, aluminum frames, and back sheets continue to climb. On top of this, policy shifts such as India’s 25% local content requirement and ongoing trade barriers in several regions are reshaping global supply dynamics. The anticipated full cancellation of China’s export rebate, already cut from 13% to 9% earlier this year, remains the single most consequential factor, with its removal set to ripple across global supply chains.

Freight costs, though currently lower, remain a wild card. Shipping rates spiked by 300–400% during the last cycle, and with port congestion and vessel shortages still a risk, logistics remain a sensitive factor in total module delivery costs. Pakistan currently benefits from relatively favorable freight arrangements compared to some other markets, but analysts warn that this advantage could narrow quickly if global shipping volatility returns. Seasonal factors such as the Chinese New Year and European holiday slowdowns also pose risks to delivery timelines in the coming months.

Global demand for PV systems has surged, with estimates placing it at 160–170 GW in 2021 and climbing since. But module production capacity, especially for high-efficiency components, struggles to keep pace. This imbalance creates a seller’s market where lead times stretch and project delays become common.

Industry observers emphasize that buyers who wait too long will inevitably face higher costs and tighter supply. Many recommend locking in current prices before the market recalibrates and exploring long-term agreements to hedge against volatility. Analysts also highlight the importance of proactive planning, given extended lead times, and stress that stability in global module pricing is unlikely to return before 2027.

For Pakistan and other emerging markets, the stakes are particularly high. The price-sensitive procurement cycles leave little room for unexpected surges. As the global solar industry braces for the next pricing wave, timely action could be the difference between profitable execution and costly delays.

The message from industry experts is unambiguous: the solar sector’s fundamentals remain strong, but the window of affordability is narrowing. Stakeholders who move decisively today will be better positioned to weather the turbulence of 2026 and beyond.