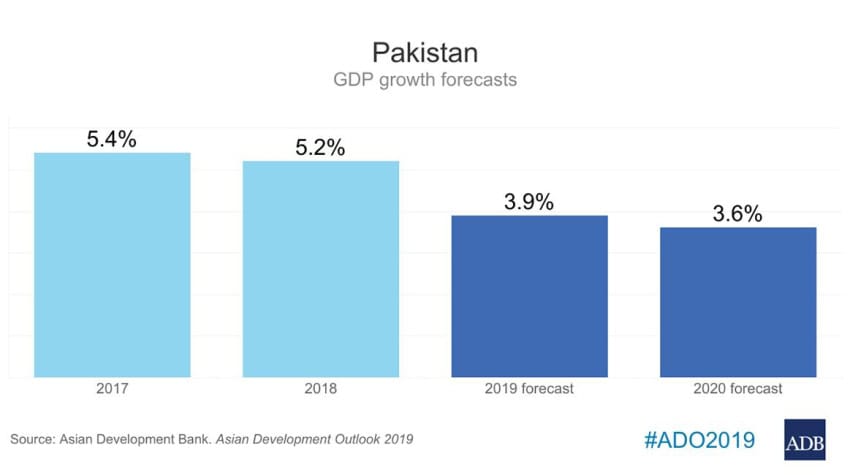

ISLAMABAD – Pakistan’s Gross Domestic Product (GDP) growth is forecast to decelerate further to 3.9% in FY2019 as macroeconomic challenges continue, said a new report of Asian Development Bank (ADB) on Wednesday.

To meet its large financing needs, the government is discussing a macroeconomic stabilization program with the International Monetary Fund in addition to arranging financial assistance and oil credit facilities from bilateral sources.

The report cautioned that continued fiscal consolidation in FY2020 would keep growth subdued at 3.6%.

Agriculture is expected to underperform the 3.8% growth target for FY2019 after water shortages struck as wet season crops were being sown.

Large-scale manufacturing reversed 6.6% growth in the first half of FY2018 to decline by 1.5% in the same period of FY2019 as domestic demand contracted and rising world prices crimped demand for raw materials.

A contraction hit all key categories, including a 0.2% decline in textiles. A slowdown in agriculture and industry as domestic demand shrinks will keep growth in services subdued.

A government structural reform package announced in January 2019 is expected to support agriculture, facilitate new business openings, and continue to expand capacity in some industries to the forecast horizon.

Stabilization policies and rising inflation are likely to contain growth in private consumption and investment, while public sector development spending has already slackened.

With exchange rate flexibility and declining imports, net exports are expected to contribute to growth.

Average inflation accelerated sharply from 3.8% in the first 8 months of FY2018 to 6.5% in the same period of FY2019, led by a surge in nonfood inflation to 9.1% that reflected currency depreciation and a significant increase in gas tariffs for consumers and industry in the first half.

Food inflation remains relatively moderate at 2.6% thanks to sufficient stocks of food staples. In response to intensifying inflationary pressures, the central bank gradually raised, in four rounds from July 2018 to January 2019, its policy rate by 375 basis points to 10.25%. Despite tighter monetary policy and lower international oil prices, inflation is expected to rise sharply to average 7.5% in FY2019, driven up by continued heavy government borrowing from the central bank, hikes to domestic gas and electricity tariffs, further increases in regulatory duties on luxury imports, and the lagged impact of currency depreciation by more than 10.7% since July 2018.

Inflation will remain elevated at 7.0% in FY2020, the report added. A supplementary consolidated government budget for FY2019, adopted in September 2018, envisages a decline in the budget deficit to 5.1% of GDP in FY2019, mainly by cutting the development expenditure excluding CPEC projects, but it

also included measures to enhance revenue and extend relief to the poor.

Growth in tax collection weakened from a robust 16.4% in the first half of FY2018 to only 2.7% a year later. The Federal Board of Revenue targets tax collection equal to only 11.6% of GDP in FY2019, taking into account reduced sales taxes on major petroleum products, drag on the collection of withholding tax from contracts, contraction in general sales tax revenue as imports slow, and the overall slowdown in the economy. Including nontax revenue, total revenue declined by nearly 2.4% in the first half of FY2019.

Budget expenditure increased by 5.5% in the first half of FY2019 over the same period a year earlier as current spending rose for interest payments and defence. Lower revenue collection and higher current expenditure pushed the budget deficit from the equivalent of 2.3% of GDP in the first half of FY2018 to 2.7% a year later. This situation will make it a challenge for the government to achieve the reduction in the budget deficit it targets for FY2019. A second supplementary budget, adopted on 6 March 2019 without information on the projected deficit, focuses on an economic reform package envisaging incentives and measures to encourage investment and exports, enhance the ease of doing business, and

strengthen export-oriented activities.

In the first 8 months of FY2019, the government borrowed more from the central bank and less from commercial banks, freeing up liquidity with which commercial banks boosted credit to the private sector by 18.9% over the same period of FY2018.

This sharply increased net domestic assets and nearly doubled broad money growth to 2.8%. The current account deficit is expected to ease in FY2019 but will remain high at the equivalent of 5.0% of GDP because of the large trade deficit. It will narrow further to 3.0% in FY2020 with easing macroeconomic pressures on the external accounts. Export growth plunged from double digits in the first 7 months of FY2018 to 1.6% in the same period of FY2019. It is expected, however, to strengthen in the remaining months of this fiscal year and further in FY2020 as the lagged impact of currency depreciation kicks in, along with the incentive package for export-oriented industries announced in January 2019.

Imports fell by 0.8% in the first 7 months of FY2019 from the same period of FY2018, with imports other than oil 5.7% lower because of slower domestic economic activity, currency depreciation, and an increase in import duties for nonessential items.

Remittances are expected to reviveóhaving already risen by 10% in the first 7 months of FY2019 over the same period of FY2018óas the Pakistan rupee depreciate further, economic activity in the Middle-eastern oil exporting countries (major destination of Pakistani migrants) holds broadly steady, and the government takes measures to facilitate remittances through official channels.

The governmentís diaspora bondsóissued in January 2019 with terms of 3 and 5 years and an attractive return of over 6%óaim to tap resources from overseas Pakistanis. Inflows that do not incur debt, such as foreign direct investment, are expected to be lower in FY2019 as several CPEC energy projects are near completion.

Financing a high current account deficit in FY2019 will require substantial borrowing, as in the first 7 months of the year, and use much of the bilateral lending support announced in the early months of 2019 to finance the deficit in the balance of payments. Foreign exchange reserves, depleted to $8.1 billion in February 2019, will likely remain stressed at the end of FY2019.