COVID-19 has left a long-term effect on everyone. Be it corporate or small businesses everyone has to respond in one way or the other.

Employers have unforeseen challenges due to travel restrictions and working remotely by employees. It is now too early to forecast the long-term effect and trends posed by pandemics, but in the short term, the most likely situations indicate that employers need to make drastic changes. They need to be more resilient than ever before. This may include starting to map out their transition to a next-generation operating model best suited for the future.

Impact on the key stakeholders

These changes in the external environment will have an effect on three key stakeholders i.e. customers, employees, vendors & partners.

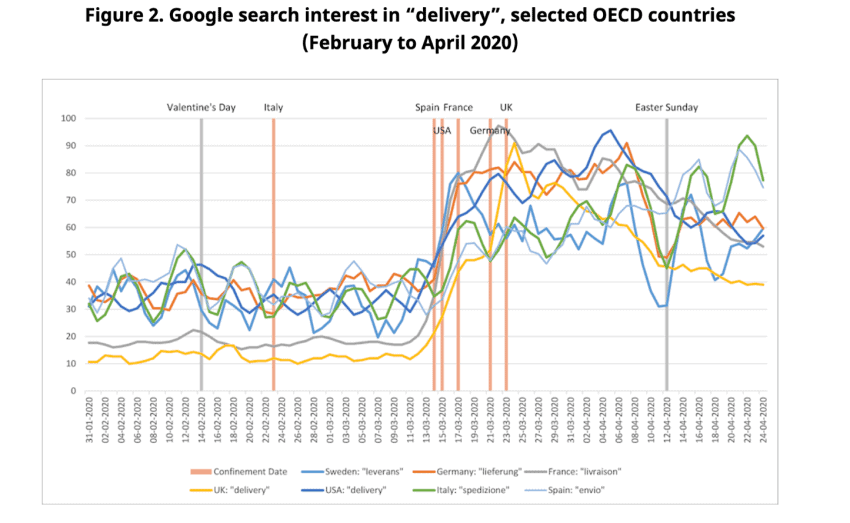

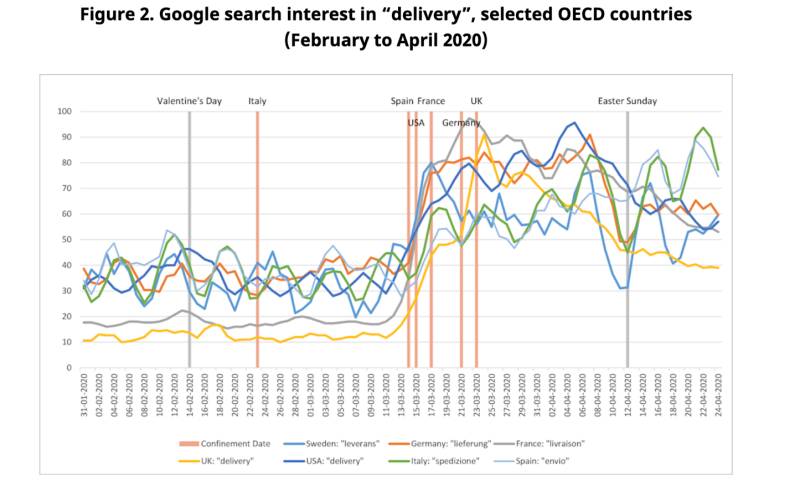

Customers have already shifted their purchasing preferences to avoid physical channels, adopted more digital services, and demand more delivery services. We have seen growth in the number of home delivery food services in the UK e.g. every big superstore has now an option to reserve & pick or buy & deliver online. Amazon has already spoiled everyone with the offers like Amazon Prime giving a number of incentives.

Amazon Prime membership grew to 153 million members in the U.S. as of June 2021, up 25.4% from 122 million in June 2020 according to CIRP’s estimates.

Source: www.oecd.org

Source: www.oecd.org

The ability to find anything on Amazon made it one of the most popular E-commerce platforms. In the USA almost 153 million Amazon customers already opted for Amazon prime and they probably have the same strategy for other markets like the UK. Offerings like Hello Fresh passing the concept of eco-friendly grocery buying and cost-effective way to spending money become a success. Price comparison sites like Uswitch, money supermarket, and meerkat already giving choices as an aggregator. Especially post Brexit when the UK is facing some immediate shortage of fuel and price hike in the energy sector. All these economic pressures make customers look for the best deals online.

People are making new commitments to their goals and values. COVID-19 has led to making the choices for example balance time spent at work and with family. At the same time, people are considering the risks and values in everyday decisions about where they go, who they spend time with, what they do, and what they buy.

According to McKinsey research employees with a stable, secure work experience working remotely report an increase in positive work effectiveness and well-being. Also, vendors and partners might be considering scaling down activities and operations, focusing on the short term, delaying unnecessary investments, and attempting to cut costs. At the same time, vendors and partners could shift to digital channels, reducing the need to visit customers on-site.

Sales channels: Shifting away from Point of Sales

To adapt to changing customer buying behavior, companies have moved from large points of sale (POS) to a reduced number of small, human-less POS, and promoted digital channels. This has started already and those who are left are looking to change in near future.

For example, DHL launched contactless delivery and payment through automated pickup points. A big telecommunications group optimized its marketing efforts by reallocating the budget to digital channels.

Amazon is another good example of this trend, with its Amazon Go physical stores providing uniquely innovative customer experiences i.e. how the digital and physical world interacts. In Amazon, Go customers scan an Amazon app when they enter the store—the only point at which a phone is required and there is no checkout. One of the stores is due to open in Bluewater London.

Product: Keep it simple to push digital sales

One way of meeting customers’ changing demands is to simplify products to spur a digital sale. A prime example is Yaqoot which is a digital platform that aims to spread happiness through SIM cards by allowing customers to download an app and to send special gifts to loved ones. This digital product was launched in Saudi Arabia and become a huge success with a growing userbase of digital natives. It is a simple & online product that gives users a seamless experience.

Due to online competition and high acquisition costs for customers companies are also looking at developing pricing models that encourage consumer loyalty, rather than short-term promotions. Also, cash might carry viruses we have seen many retailers asking to pay only through contactless, and in the future e-wallet and cashless become normal.

Service and support: Moving to a remote digital service

Organizations also changing their after-service and support models. The digital-native Russian bank Tinkoff was the first one in 2012 to launch cloud-based remote call centers outside of Russia. The bank focused on remote servicing and now has more than 14000 remote employees who work from home and take half a million calls every day. These do not even bank permanent employees. This model has saved bank costs for offices, equipment, and workplaces.

We can also see chatbots are very common when it comes to reaching out to service support. This automation help organizations to work with cost efficiencies.

Workplace: Shift to digital remote office

Many organizations have already shifted to remote offices and have begun conducting large-scale meetings. Mix models like agile ways of working also provide success where some quarterly meetings are held in person and rest via online calls.

Companies in the UK now offer flexible working days e.g. employees can opt into work from home for 2 days and 3 days from the office. Some are giving 100% remote working options especially within digital media agencies where face-to-face meetings are not necessary. There are enough tools available to monitor employees’ performance keeping track of records of day-to-day work. For example, the Trello app is used for project management, and similar solutions seem to be successful.

Vendors and partners: Shift to collaborative partnerships

One of the biggest challenges for supply chain executives is to make sure they have a smooth supply of goods. Since consumers panic and piled up stock during the peak time of COVID-19 there was no mechanism to fulfill that kind of demand. In the UK big supermarkets like TESCO, ASDA and Sainsbury saw a severe shortage of household essentials and food items as people are scared and bought these items in bulk due to future uncertainty.

Companies are now actively looking to streamline supply chains right from suppliers to merchandising to distribution to logistics to finally to fulfillment. Most priority is given to food, drugs, and essential items to make sure isles are filled coping customers demand.

Covid-19 has forced businesses to take a paradigm shift. Many industries like travel, hospitality, entertainment, and outdoor recreation like Disney had to lay off thousands of employees. They need to find out new ways of doing business in order to make it profitable in the post-COVID-19 world.