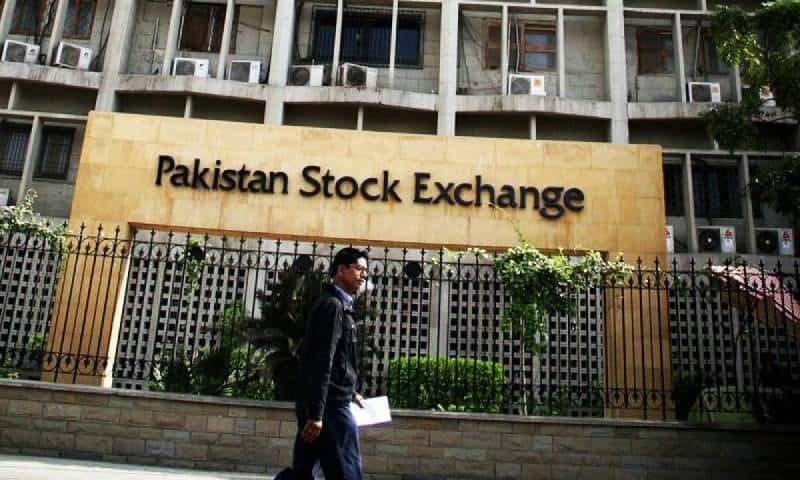

KARACHI – The Pakistan Stock Exchange (PSX) experienced a strong performance on Friday as the market saw an increase of over 700 points during intraday trading.

The KSE-100 index rose by 712.53 points, or 0.98%, reaching 73,370.58 points at 10:58am, up from the previous close of 72,658.05.

Mohammed Sohail, chief executive of Topline Securities, suggested that inflation might decrease more quickly than anticipated, prompting investors to buy shares in companies that would benefit from lower interest rates.

The stock market had rebounded from a three-day losing streak the previous day, as selective value-hunting helped the KSE 100-share index close in positive territory.

Yousuf M Farooq, director of research at Chase Securities, explained that traders were expecting inflation for May to be around 15% and were anticipating a drop in interest rates over the next financial year. This fueled enthusiasm in cyclical stocks.

Ahsan Mehanti of Arif Habib Corporation attributed the mild recovery at PSX to the World Bank’s reaffirmation of its commitment to collaborate with Pakistan on structural reforms and sustainable development.

He also pointed out discussions on privatizing struggling state-owned enterprises, anticipation ahead of new loan talks with the IMF, and the expected visit of the Saudi crown prince to finalize investment deals under the Special Investment Facilitation Council.

Raza Jafri, chief executive of EFG Hermes Pakistan, added that expectations for monetary easing continue to grow as real interest rates are now approximately +5% and the external account remains stable.

He noted that previously underperforming leveraged sectors such as cement are attracting buying interest from both local and foreign investors.