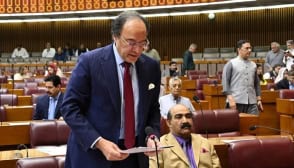

Pakistani government is all set to present its maiden budget for 2024-25 in parliament today. This year’s Budget is expected to be major step towards IMF agreement, as it will help PML-N led government to clinch much-needed funds.

The government aims to achieve primary surplus of up to Rs700 billion in the upcoming fiscal year with apex tax collection authority setting the target of Rs12.9 trillion.

Key Revenue Measures in Budget 2024-25

- More Taxes on retailers/wholesalers to boost revenue

- Surge in tax rates on non-filers

- Exemptions on FATA/PATA to be slashed

- Introduction of Carbon Tax or increase in Petroleum Development Levy (PDL)

- Reforms in personal income tax

- Increase in FED on cigarettes

- FED on nicotine pouches and e-cigarettes

- Removal of exemptions or increased sales tax on goods

As the government is tightening policy, the top tax collection authority will increase direct taxes to rise by 3-5 percent with 25pc YoY growth in absolute targets, driven by increases in existing tax rates and broadening the tax base.

On the recommendation of lender, the government is planning to have non-tax revenue target at Rs. 2.1 trillion.

The government eyes GDP growth target of 3.6pc and an inflation target of up to 12.7pc for FY25. The KSE 100 Index is projected to benefit from a PE re-rating with the approval of a new IMF financing facility, potentially reaching 87,000 points by December 2024 and 106,000 points by June 2025, assuming the successful implementation of the IMF program.

The development expense budget is expected to exceed Rs1 trillion, similar to last year’s levels, with the Public Sector Development Program (PSDP) also at Rs. 1 trillion. Subsidy and pension expenses are expected to rise by 42% and 20% respectively, while the defense budget is anticipated to be limited to Rs. 2 trillion (+11% YoY).

Despite achieving a primary surplus for FY24, the massive Rs. 10 trillion in interest payments for FY25 could result in an overall fiscal deficit of 6.8% of GDP, potentially hindering growth.

In short term, the budget is expected to have a neutral to negative impact on the stock market. However, if the government implements realistic revenue measures to achieve targeted tax collections as per IMF expectations.

Taxes

| Measure | Details |

|---|---|

| Petrol Tax |

|

| Mobile Phone Taxes |

|

| Climate Budget | Budget ceiling for the Ministry of Climate Change may be raised to Rs. 15.87 billion. |

| IT Ministry Budget |

|