Market analysis provided by Quoc Dat Tong, Financial Markets Strategist at Exness.

The cryptocurrency market has come a long way since 2008, when bitcoin (BTC) became the first decentralized digital currency. Its scarcity, decentralization, and early-mover advantage made it the foundation of the digital asset space. Then came Ethereum (ETH) in 2015, a network designed not just for transactions but for programmable money.

Ten years later, the competition between bitcoin and ethereum continues to shape the entire crypto landscape. Ethereum’s flexibility, smart contracts, and scalable architecture have transformed it from an alternative to bitcoin into a catalyst for decentralized finance (DeFi), NFTs, and beyond.

Smart contracts and a solid ecosystem fuel Ethereum’s power

Historically, ethereum has proved to be a viable digital asset. Less expensive than bitcoin, the cryptocurrency is fueled by a smart-contract-based ecosystem, which contributes to its heightened flexibility compared to bitcoin. This flexibility allows developers to build other projects on its network, which explains the emergence of millions of different crypto tokens on the Ethereum network long after ETH was launched.

The first token launched on the Ethereum network was the ERC-20 fungible token, a type of standard that allows developers to create, issue, and manage cryptocurrencies supported by ETH. Remember the 2017-2018 ICO bonanza? Since then, the ERC token standard has expanded, adding the ERC-721 (non-fungible token standard) and ERC-1155 (semi-fungible token standard).

Smart contract compatibility enables the Ethereum network to support a wide range of different tokens. This gives developers immense flexibility, allowing them to create and launch their own digital asset without launching a whole blockchain network.

ETH’s journey to DeFi

Besides flexibility and smart contracts, ETH brought enhanced transparency to the crypto space. Unlike its predecessor, whose creation was attributed to a mysterious developer or group of developers known as “Satoshi Nakamoto”, ETH is the brainchild of Vitalik Buterin, Gavin Wood, Charles Hoskinson, and other prominent co-founders.

Its launch was accompanied by a white paper that clearly outlined its concept and purpose: a scalable, open-source network for decentralized applications (DApps) and seamless peer-to-peer transactions without intermediaries.

Ethereum laid the groundwork for a new era of digital assets. Its straightforward foundational vision to decentralize online transactions, eliminating the middlemen (i.e., banks, credit card companies, and payment processing platforms), paved the way for future network developments.

The period between 2017 and 2020 saw the launch of multiple Ethereum network upgrades, including the Beacon Chain, which facilitated the shift from the proof of work (PoW) consensus mechanism to proof of stake (PoS) in 2022. This shift fuelled ethereum’s rapid scale.

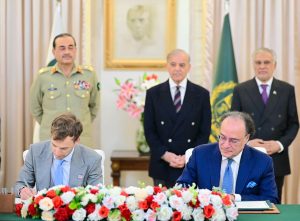

Many applications have been built on the Ethereum blockchain over the past decade, from DeFi applications to NFT marketplaces, and beyond. Institutional investors became increasingly interested in what ethereum had to offer. To such an extent that in 2024, the cryptocurrency received massive institutional backing with the launch of eight spot ETH exchange-traded funds (ETFs). This marked a turning point for ETH, demonstrating its viability as a must-have digital asset—a perception that still prevails.

Ethereum as a digital asset “with yield”

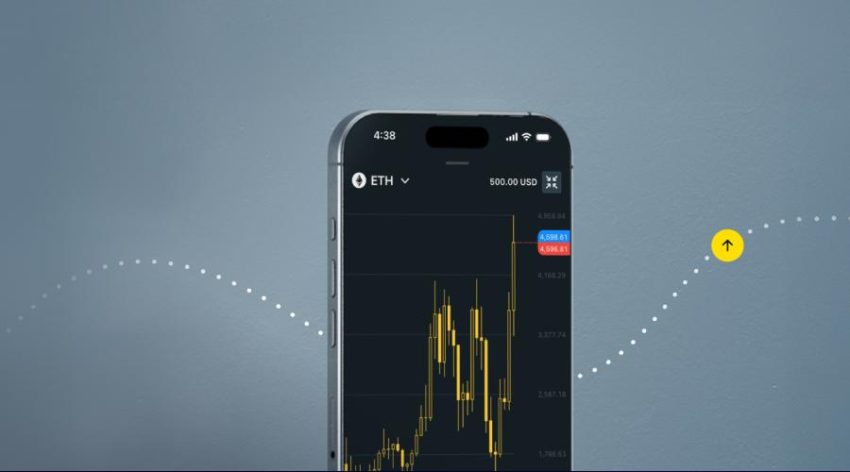

2025 saw bitcoin’s market cap skyrocket to 1.34 trillion USD, almost doubling from last year’s low. During Q1 of 2025, ethereum’s daily transaction volume totaled more than 17.2 billion USD, outperforming bitcoin for the fourth consecutive quarter. As the year progressed, ETH, the second-largest digital currency by market capitalization, gained even more traction.

In August 2025, ETH surpassed the psychological 4,000 USD mark for the first time, as global markets had already priced in a Federal Reserve interest rate cut announced by Fed Chair Powell. Cheered by crypto bulls, this watershed moment for ETH was not surprising for institutional figures like Ryan Sean Adams, co-founder of Bankless, who had predicted ethereum’s bull run since October 2024.

Adams, who had been carefully following ethereum’s performance, came forward with a bold projection of what ETH would reach. Broken down, this would account for nearly 17,000 USD per token. This theory is underpinned by a transformative narrative of repositioning ethereum as a form of “digital gold with yield”, which is not far-fetched at all, considering its evolution over the past two quarters of 2025.

Analyzing ethereum’s fundamentals, its evolutionary path begins to unfold three years earlier. Following its merge in 2022, ETH started behaving more and more like a yield-generating asset or a deflationary commodity. The staking rewards and the fee-burning mechanism introduced through the EIP-1559 protocol were key transformative drivers. Consequently, ethereum evolved into a hybrid digital asset that possessed the same store-of-value characteristics as bitcoin, with the yield-bearing nature of US Treasuries.

This vision quickly gained traction within professional investment circles. ARK Invest, for example, likened ETH staking to “digital bonds” while others associated it with “digital silver” and even “digital oil”.

Neither of these perspectives is totally new, and each tackles key facets of the digital asset. Thanks to its robust technology underpinning DeFi projects, NFT marketplaces, alongside a plethora of other applications, ETH exceeds bitcoin’s applicability by far. Ethereum has stopped being a mere money-moving vehicle.

Therefore, it serves as both a store of value and a yielding commodity in the digital space. It’s utility-focused, offers greater liquidity, there’s no limit on ETH’s supply (whereas bitcoin will stop being mined when supply reaches 21 million coins), and it has a store-of-value characteristic that resembles that of silver.

At the same time, ethereum’s interoperability, wide-range applicability beyond finance, swift integration, and compatibility with other software replicate oil’s behavior in the digital world.

Like nations regularly refill their oil stockpiles, corporations stash up their ETH treasuries. The fact that 69 global corporations collectively hold over 4.1 million ETH (17.6 billion USD) in their reserves reinforces this hypothesis. With this in mind, whether ETH will solidify its commodity-like position remains to be determined.