ISLAMABAD – Pakistan’s newly elected government is in talks with International Monetary Fund for additional funding to tackle economic challenges, and global lender has suggested government to tap more sectors.

During the talks, IMF has reportedly asked Federal Board of Revenue to impose additional taxes on the retail, real estate, besides bringing cryptocurrencies into tax net.

The global lender wants Pakistani authorities to mandate property developers to track and report all transfers before property titles, with penalties for non-compliance.

The stern recommendations could become part of an upcoming bailout package and the Federal Board of Revenue of Pakistan may incorporate them into the 2024-25 budget.

IMF identified challenges in taxing capital gains from real estate transactions, as property interests are often not registered until the property is legally completed, leading to untaxed profits from transfers before completion.

Reports in local media suggests that visiting delegation suggested taxation on nnew types of investments like cryptocurrencies. It has also proposed that capital gains on real estate and listed securities should be taxed regardless of how long they have been held.

The multilateral institution also recommended amending the definition of “personal movable property” in the Income Tax Ordinance to include a broader category of assets that can be held as investments, excluding those used as stock in trade or assets that depreciate.

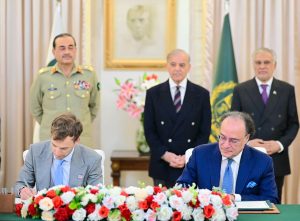

Pakistan close to sign IMF agreement to unlock 1.1bn under SBA