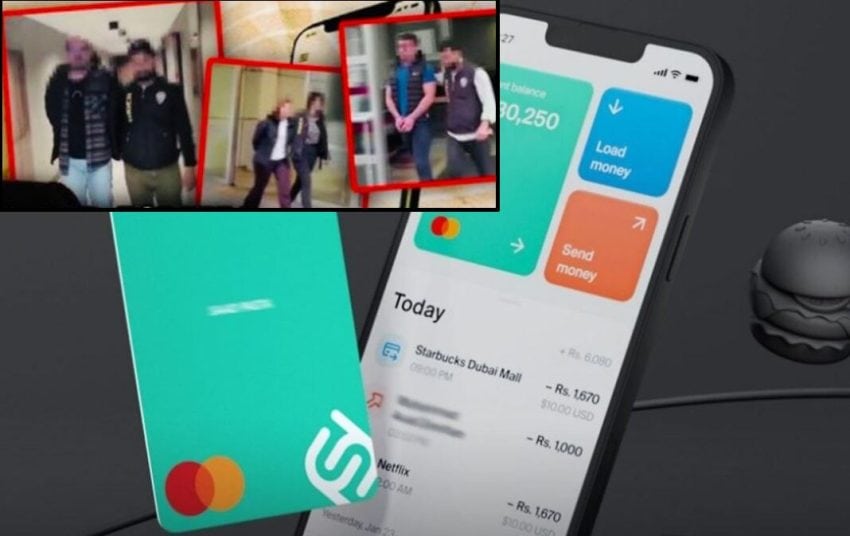

KARACHI – SadaPay, Pakistan’s growing digital payment platform, is facing reputation risk as Turkish authorities detain founder of its parent firm Papara for $330Million betting ring, and money laundering.

It started with stern action from Turkish authorities with arrest of more than one dozen individuals linked to fintech giant Papara, the parent company of SadaPay after a criminal network was exposed.

Papara which acquired Pakistan-based SadaPay last year is now under scrutiny in different country. Turkish Interior Minister said Papara accounts were being used to channel illegal betting proceeds. More than 26,000 user accounts were reportedly linked to transactions worth $330 million – which equates to 93.39 billion in Pakistani rupees.

Papara’s founder Ahmet Karslı and others are facing action with central bank imposed daily transaction limits on Papara’s services. Though Turkish regulators reassured users that funds remain protected under national financial laws, the move signals serious operational disruption.

The action raised questions in Pakistan’s fintech ecosystem about future of SadaPay, which has been celebrated as a rising digital banking platform with a growing user base and innovative mobile-first services.

While SadaPay operates independently under Pakistan’s regulatory framework and has not been named in Turkish investigation, industry insiders are closely watching for any indirect consequences. People are also looking at SBP to issue an official statement regarding the matter.

Any instability in the parent company raises concerns about cross-border compliance, data security, and investor confidence.

Turkish firm Papara is majority-owned by PPR Holding, with Karslı reportedly holding big chunk of the company. After the arrests, several of the firm’s bank accounts, assets, and affiliate companies have been frozen.

Neither SadaPay nor Papara have issued public statements in response to the unfolding situation. However, customers and regulators in both countries are now demanding clarity on how the investigation may affect day-to-day operations and the safety of user funds.

How Chinese-owned Call Center in F-11 Islamabad scammed Pakistanis; full details here