In the intricate framework of international affairs, Geo-Politics (GP) and Geo-Economics (GE) stand as pillars determining the global landscape. GP defines the strategic interactions, while GE underscores the economic underpinnings among nations. Both concepts are necessary to understand power dynamics and world stage influence. Against this backdrop, countries like Pakistan find themselves at a critical stage where aligning their GP with their GE demands particular consideration. This insight is an attempt to evaluate and potentially realign Pakistan’s GE policies to meet the challenges posed by its evolving GP context effectively.

Pakistan was aligned with the US-led Western bloc during the Cold War regarding GP and GE. This alignment was driven more by strategic needs than shared values, profoundly influencing Pakistan’s political, economic, and ideological trajectory. However, Pakistan’s GP interests have steadily tilted towards China in the post-Cold War era, whereas its GE interests remain anchored with the US-led West. It was necessitated as the US-led West chose India, not Pakistan, as a strategic partner in the larger context of potential US-China Rivalry. Hence, India was designated as the net security provider in the US Indo-Pacific strategy. Pakistan had to turn to China for its economic and security requirements.

To further illustrate this argument, let us examine Pakistan’s trade relations with various regions over the past two decades. Analysing trends in trade with ASEAN, China, the Middle East, Africa, Europe, Central Asia and North America can provide insight into Pakistan’s GE alignment in post-Cold War.

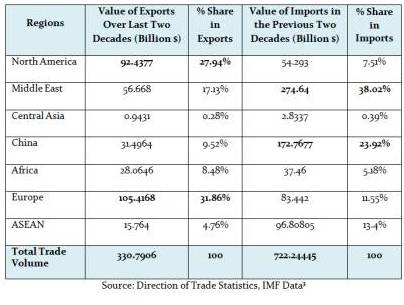

The data analysis reveals a distinct pattern in Pakistan’s export dynamics over the past two decades, particularly in comparison with various global regions. Notably, a substantial portion, approximately 27.9%, of Pakistan’s total exports during this period have been directed towards North America. In contrast, exports to other regions such as ASEAN, China, the Middle East, and Central Asia have remained relatively minimal. On the other hand, it is interesting to identify that Pakistan has experienced a significant 31% share in its exports to Europe. Preferential trade agreements such as GSP+ and strategic engagements like the EU-Pakistan Strategic Plan (SEP) have significantly contributed to regional trade growth.

For Pakistan to enjoy greater liberty of action in the geopolitical arena, it must diversify its geoeconomics profile by adding new export destinations to the US and Europe.

In contrast, an analysis of the import trends presents a nuanced picture. By examining Pakistan’s trade dynamics, it is apparent that the country’s import portfolio showcases a diverse array of sourcing regions, with considerable contributions from North America, the Middle East and China. Imports from North America signify a modest portion of Pakistan’s total trade, standing at 7.51%, which indicates a diversified strategy to minimise reliance on any single region. In stark contrast, the Middle East is a crucial trading partner, contributing 38% to Pakistan’s total trade. Oil imports primarily drive this substantial percentage, underlining its vital role in Pakistan’s energy needs. Conversely, imports from China have also seen notable growth over the last two decades, accounting for 23% of Pakistan’s total trade.

Data also shows a discernible increase in Pakistan’s exports to European markets, inferring a strategic diversification effort and a subtle GE tilt towards Europe, as shown in the graph. However, Pakistan’s import portfolio has highlighted a strategic pivot towards the Middle East and China as Pakistan’s most significant import destinations, as depicted in the graph. For the remaining regions, there has been a consistent pattern over the years that merits the attention of policymakers.

The data reveals that Pakistan’s GP trajectory has significantly evolved; however, its GE landscape remains unchanged, albeit with some improved statistics with China. Despite strong GP ties, the relatively low volume of Pakistan-China bilateral trade, which is significantly tilted in favour of China, highlights a notable gap in accessing untapped GE potential between the two nations.

It is high time we understood that GP and GE are interlinked. The GP environment has transformed into a multipolar world, and new potential markets are now available to explore. Against this backdrop, Pakistan needs to recognise the inevitability of diversifying its GE focus further, including strengthening ties with emerging markets in Africa and capitalising on opportunities within the dynamic Chinese, ASEAN, Middle East, and Central Asian markets. This strategic pivot aims to enrich Pakistan’s role as a regional connectivity hub while confirming robust economic engagement across diverse geographic spectrums.

For Pakistan to enjoy greater liberty of action in the GP arena, it must diversify its GE profile by adding new export destinations to the US and Europe.