LAHORE – Punjab Chief Minister Sardar Usman Buzdar on Thursday inaugurated Rs 30 billion Punjab Rozgar Scheme to provide loans to the youth in the province.

The project is a flagship initiative designed with the total cost of Rs30 billion to provide subsidized credit facilities to the micro, small and medium (MSMEs) startups and existing business in collaboration with Commercial Banks.

Government of the Punjab will provide Markup Support and Risk Coverage to minimize cost of commercial loans for the MSMEs, and to overcome pandemic effect of COVID-19 on existing business.

Here is the process to apply online for loan under Punjab Rozgar Scheme as application cannot be downloaded from its web portal.

As you access the web portal of Punjab Rozgar Scheme, homepage will appear and you will click on “Applicant Signup” button to proceed further.

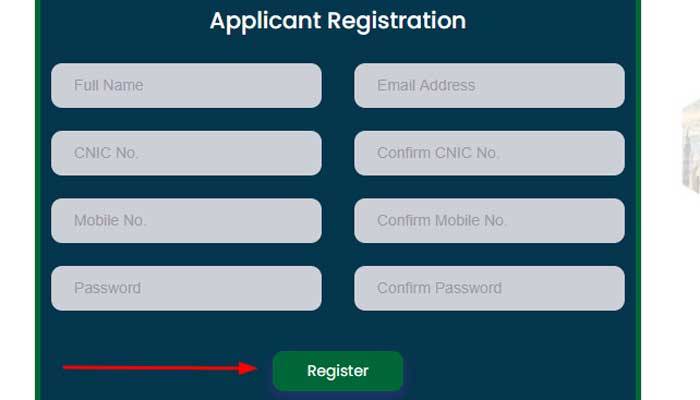

After clicking the button another window will pop up requiring details of the applicants, including name, CNIC, etc. After filling the form, click “Register” button.

As you are get registered, homepage will appear again where you will enter your Login details.

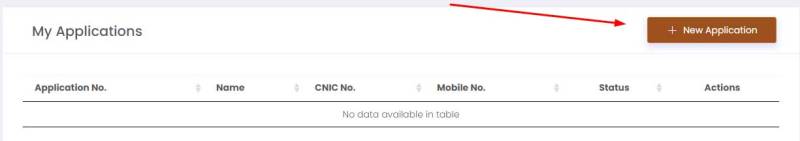

Once you Login, you will land on profile page where you will click “New Application” button.

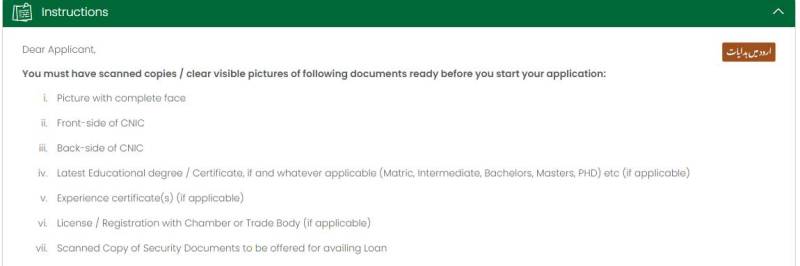

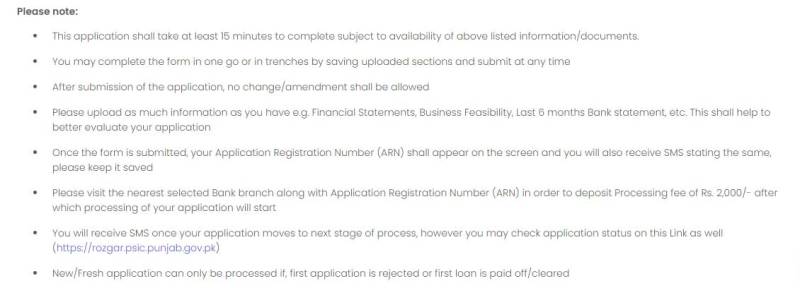

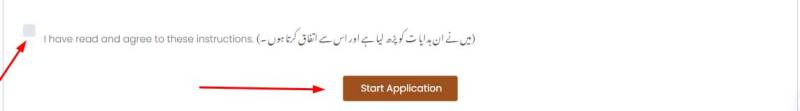

In next step, you will be shown a list of documents require for filling the application and the instructions. Read the complete page carefully and click on “read and agree instructions” to start the application.

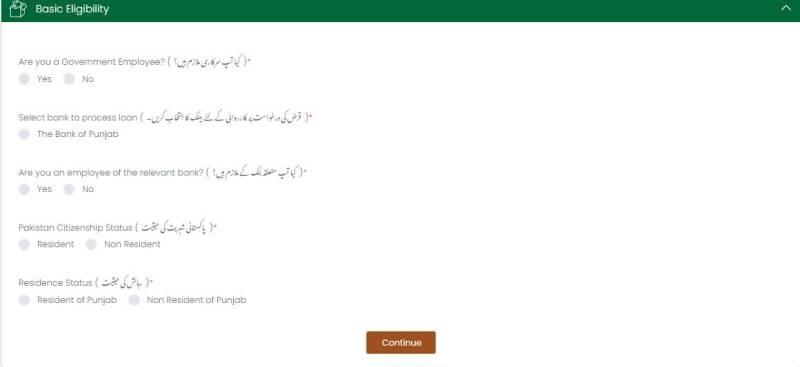

Once you agree the instruction, a list of questions to assess your eligibility will appear. Check the appropriate option and then proceed.

At this step, you be asked about what kind of loan you are applying for. Here you will select the option “Punjab Rozgar Loan”.

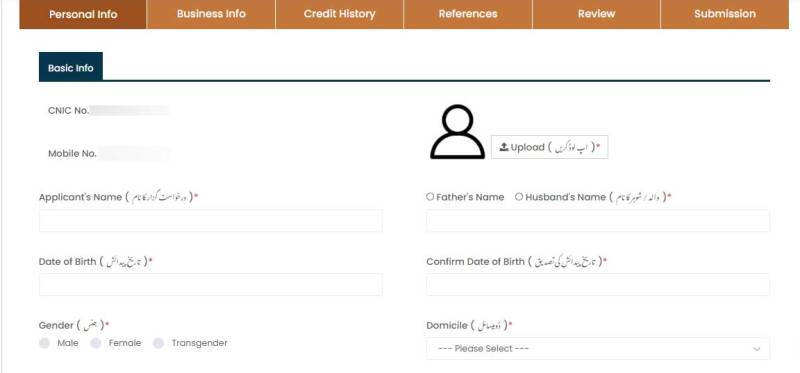

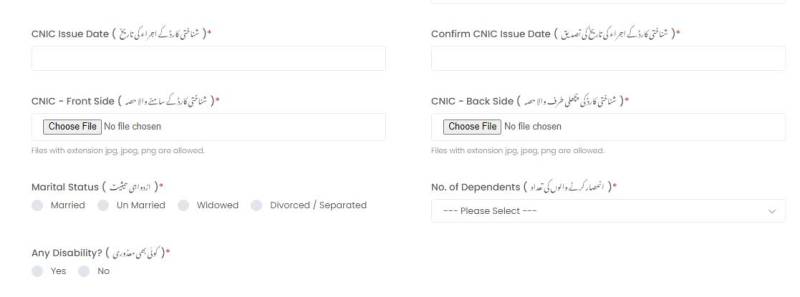

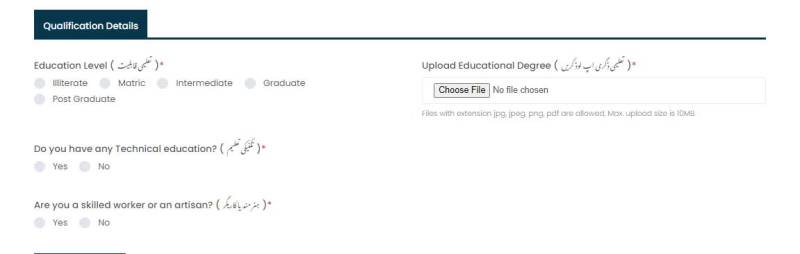

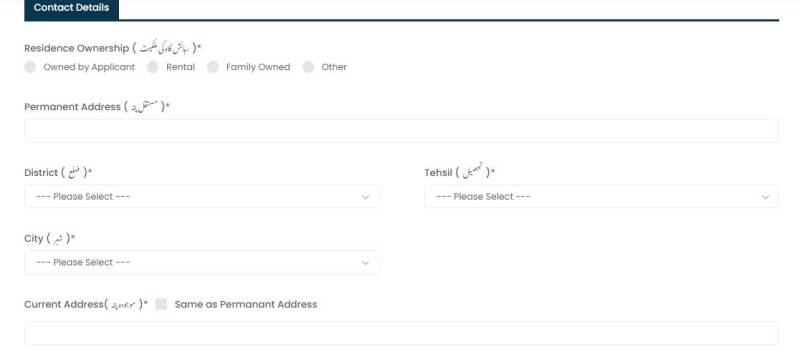

Your profile will be created for the loan. In the first step, you will provide details about personal information and upload your picture.

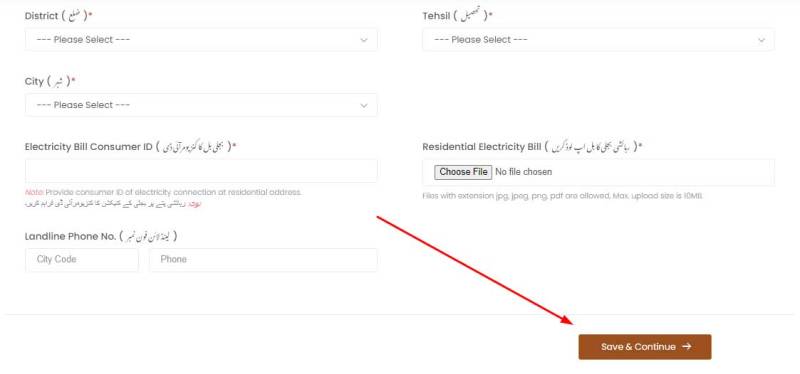

In the next step, the applicant will have to upload a copy of his/her electricity bill. After uploading, you will click “save and continue” button.

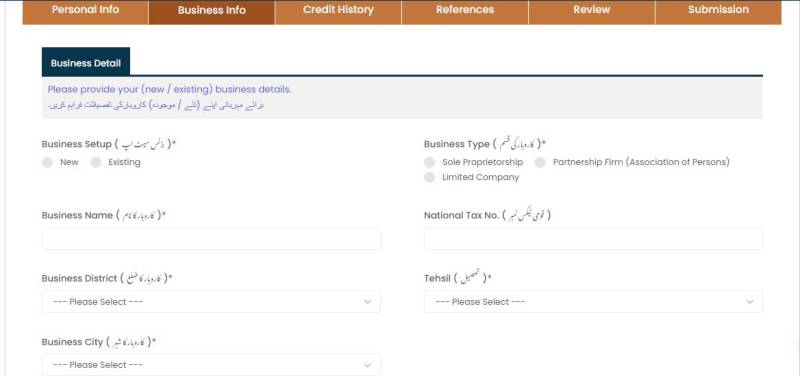

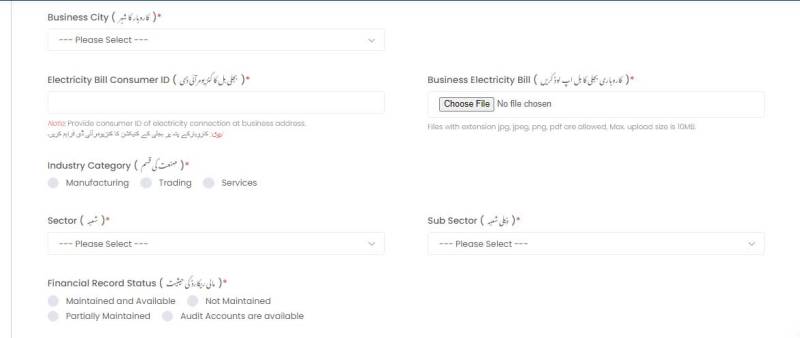

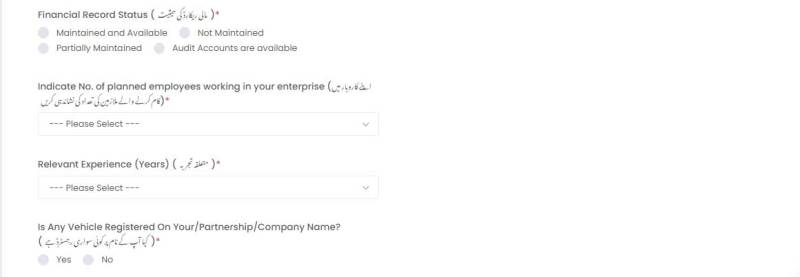

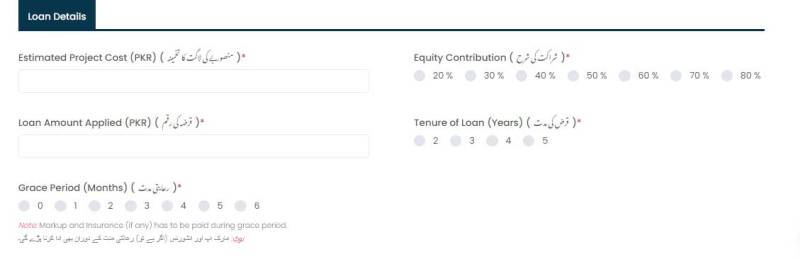

After submitting personal details, you will now have to provide business details and type of company.

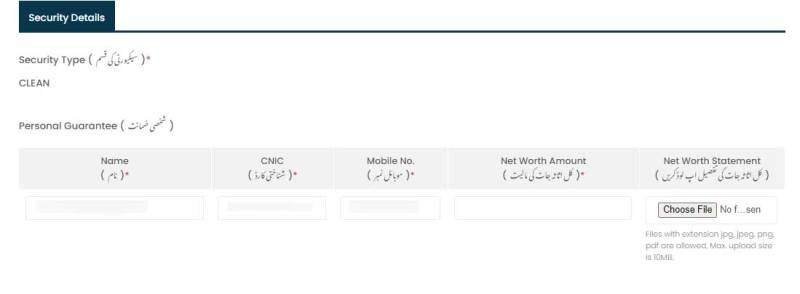

Now, a form demanding security details will appear. You will add details about the personal guarantee, including name of person, CNIC, net worth amount, etc.

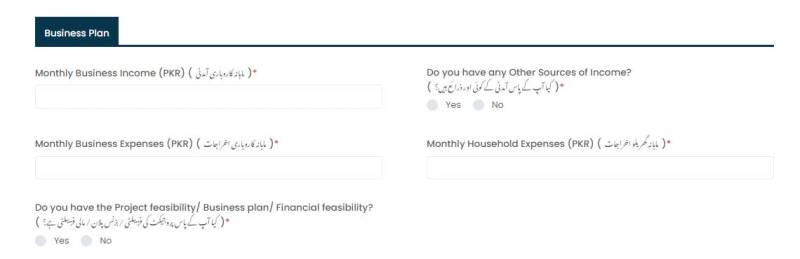

As you complete the security details form, you will have to provide details about your business plan.

After filling your security details the portal will then ask you for your business plan. You will have to provide details of monthly business income, expense and monthly household expense.

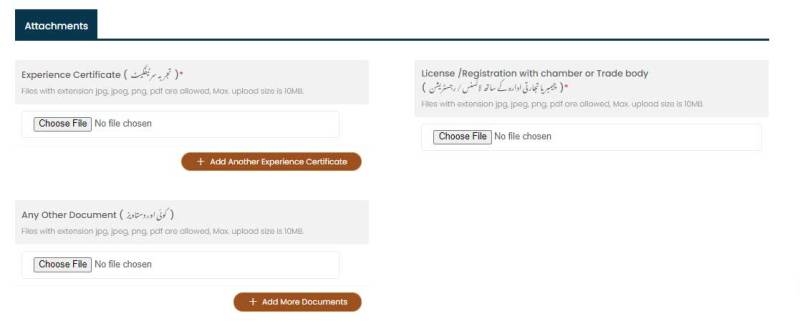

At this step, you will be asked to upload experience certificate and other documents.

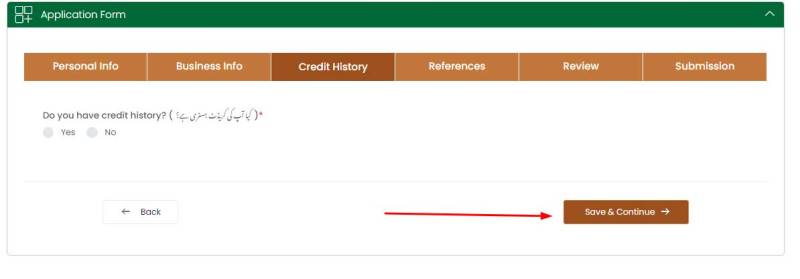

After submitting the experience certification, you will enter third part of the application where a question about your credit history will appear. You need to check “yes” option if you have history otherwise click no button and move further.

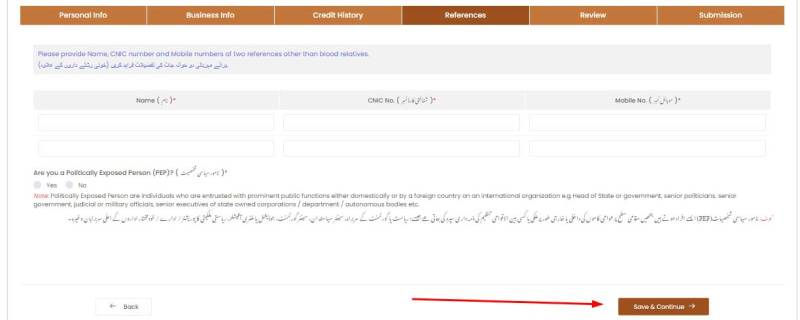

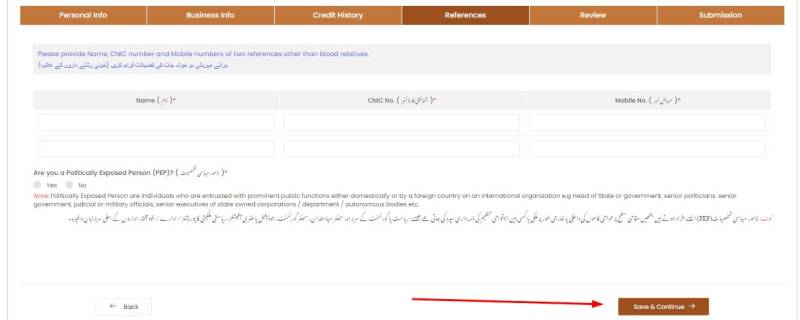

Now, you will land on fourth part of the loan application. Here, you will be required to give details of two references.

You will also be asked if you have affiliation with any political party. After adding these details, select save and continue.

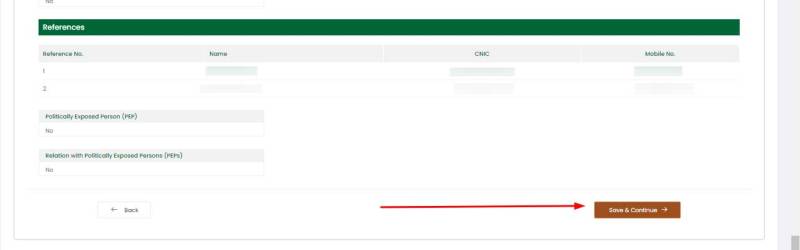

In the next step, you will be provided a chance to review the details you have submitted in the application.

https://en.dailypakistan.com.pk/digital_images/large/2020-10-01/here-is-complete-process-to-apply-online-for-punjab-rozgar-scheme-1601564240-9353.jpg16

After carefully reviewing the details, you will click “save and continue” option. After completing this section, you will land on the submission section.

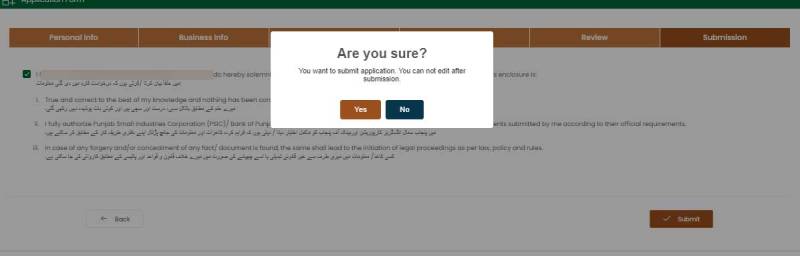

Here you need to check the box submit after agreeing that provided details are true.

The portal will ask for a second confirmation. Here, you can select no option if you have doubt about the details otherwise you will select yes option.

After completing the process, you will receive a text message on mobile number confirming your registration.

The message will also carry your application number, and will ask you to submit the Rs 2,000 application fee at any Bank of Punjab branch.