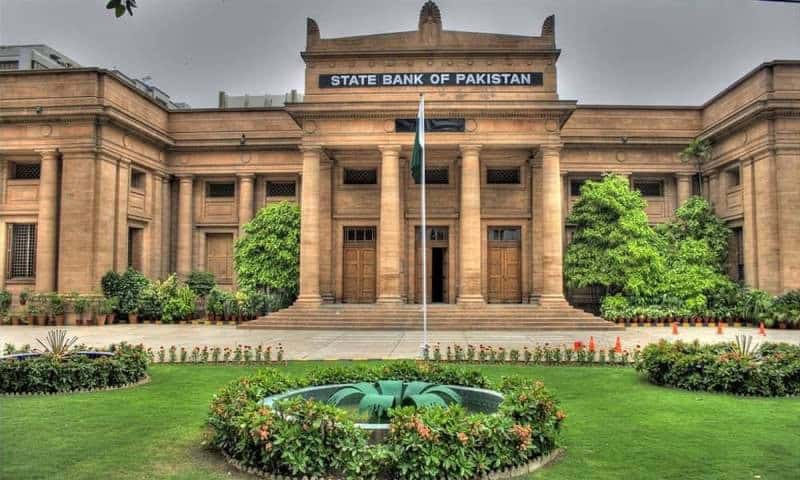

KARACHI – The Monetary Policy Committee (MPC) of the State Bank of Pakistan on Monday decided to cut the policy rate by 250 basis points to 15 percent, effective from November 5, 2024.

Fixing the policy rate at 15% from previous 17.5%, the Committee noted that inflation has declined faster than expected and has reached close to its medium-term target range in October.

It assessed that the tight monetary policy stance continues to play an important role in sustaining the downward trend in inflation. Moreover, a sharp decline in food inflation, favourable global oil prices and absence of expected adjustments in gas tariffs and PDL rates have accelerated the pace of disinflation in recent months.

Taking into account the inherent risks associated with these factors, the MPC assessed that the near-term inflation may remain volatile before stabilizing within the target range.

MPC noted that various developments since its last meeting that could have implications for the macroeconomic outlook.

It highlighted that the IMF Board approved Pakistan’s new EFF program, which has reduced uncertainty and improved the prospects for realization of planned external inflows.

The surveys conducted in October showed an improvement in confidence and a reduction in inflation expectations of both consumers and businesses, it said.

“Third, the secondary market yields on government securities and KIBOR have declined substantially. Fourth, tax collection during the first four months of FY25 fell short of target,” read SBP’s official statement.

Lastly, while the global oil prices have exhibited significant volatility amidst escalating geopolitical tensions, prices of metals and agricultural products have increased notably.

Considering these developments, the committee viewed the current monetary policy stance as appropriate to achieve the objective of price stability on a durable basis by maintaining inflation within the 5-7 percent target range.

“This will also support macroeconomic stability and help achieve economic growth on a sustainable basis,” it said.