ISLAMABAD – The Federal Government has unveiled its budget for the fiscal year 2024-25 in the National Assembly, shedding light on potential alterations in income tax rates and slabs.

Finance Minister Mohammad Aurangzeb highlighted the imperative of implementing income tax reforms, following the recent reforms introduced by the Federal Board of Revenue (FBR). He stressed the importance of aligning income tax rates with international standards through the application of personnel income tax reforms.

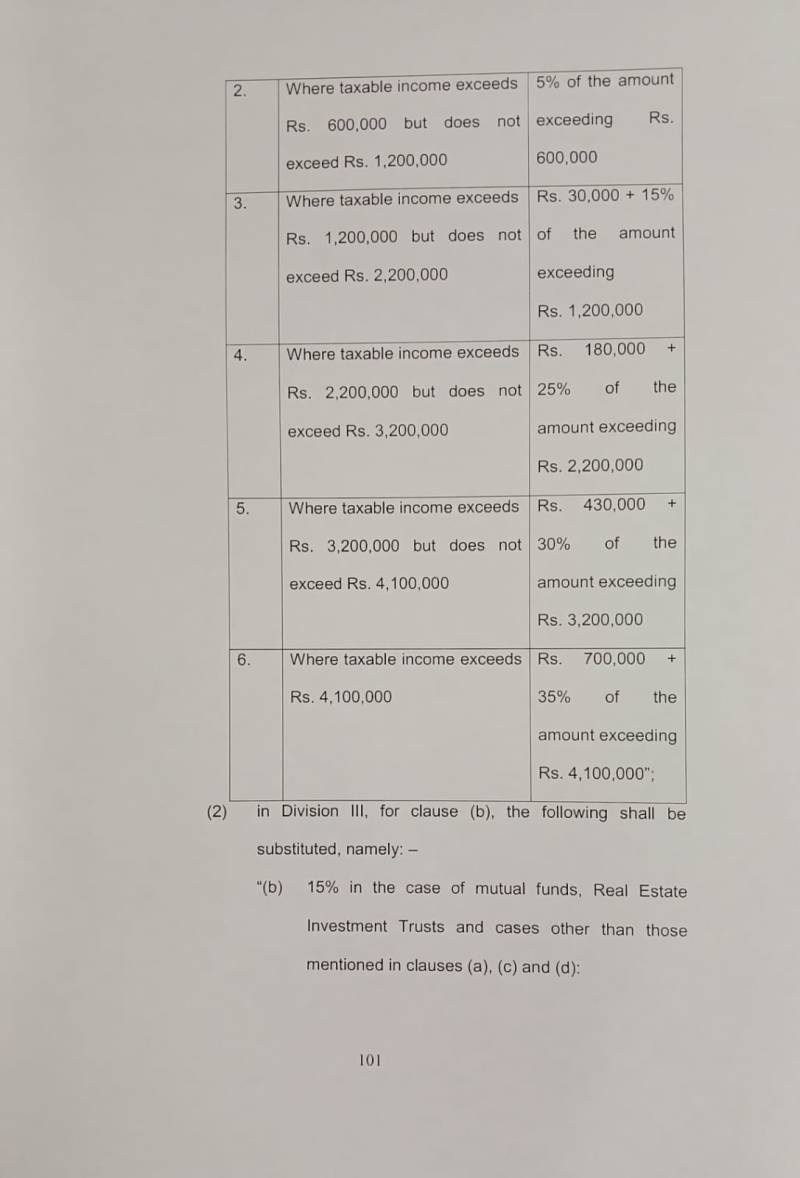

Aurangzeb affirmed the proposal’s commitment to maintaining the income tax exemption threshold at 600,000 rupees and ensuring no hike in the tax rate for the salaried class. Nevertheless, adjustments are proposed in the tax slabs to foster fairness and equity in taxation.

Under the proposed changes, the tax rate for non-salaried individuals is slated to be set at 45 percent, aimed at ensuring a proportionate contribution from high-income earners.

While the government refrains from altering the minimum and maximum tax rates, it hints at potential adjustments in the tax slabs during the fiscal period.

Pakistan allocates Rs2,122b for defence sector in budget 2024-25