The size of Pakistan’s GDP is around $300 billion. If the informal economy size is about 30%, then the total economy size would be around $390 billion. A month-long lockdown will take out $32.5 billion if there is zero economic activity. Since telecom, utilities, banking, e-commerce, freelancing, work from home by content writers, advertisers, programmers, teachers and graphic designers still going on along with wholesale/retail trade of fast-moving consumer goods and activities in rural farms, we can expect the loss to be about 60% to 75% off when there is zero economic activity. So, by rough estimates, a month-long lockdown would have trimmed GDP growth by 1% at least. A prolonged lockdown or slowdown in economy for another two months may very well make overall economic growth negative as feared by World Bank in its latest economic assessment for the country. A further decrease in interest rates amidst lower expected inflation and lower international oil prices can help in meeting the challenge of worsening fiscal deficit and decline in economic growth.

Following the outbreak of COVID-19, the government has cut interest rate by 2.25% in two phases from 13.25% to 11% and announced investment incentives for the construction sector. The construction sector was specifically targeted since it has a significant potential to provide employment to masons, electricians, plumbers, painters, welders, carpenters and those retail and wholesale businesses who sell the tools and accessories related to construction. A lot of other industries are connected with the construction sector namely, steel, cement, paint and varnishing, brick, cables, pipes, aluminium, marble, tiles, ceramics, electric lighting, fan, electronics, furniture, curtain, carpet and rugs, plastic, spare parts, transport, electricity, gas, banking and insurance to name a few.

State bank has also taken other steps to support the economy. These include i) relaxing the Debt Burden Ratio requirement from 50% to 60%, ii) reducing the Capital Conservation Buffer from its existing level of 2.50% to 1.50%, iii) Deferring the payment of principal on loans and advances by one year and iv) introducing refinance scheme for the financing wage bill.

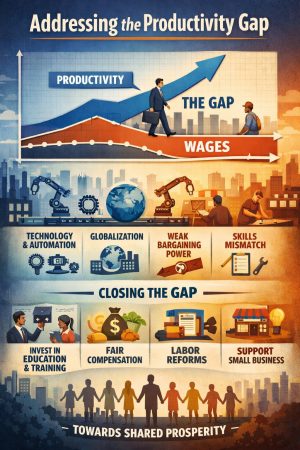

We have a workforce hungry for work even at lower wages and businesses that are anxiously looking to survive. Falling oil prices have provided an opportunity to become competitive. Realignment in product mix can help the textile, pharmaceutical, surgical goods, cement, processed food and hygiene industry.

Textile industry can produce goods which are used in hospitals and medical care, such as towels, bedsheets, face masks, handkerchiefs, and suits worn by medical practitioners and patients, for instance.

Pharmaceutical companies can meet the demand of antibiotics, anti-viral and other medicines not only for the local market but also for neighbouring countries. Surgical goods industry can also join the global value chain and supply the surgical instruments used in intensive medical care.

Just like Pakistan, other countries will also look for dealing with massive unemployment by supporting labour-intensive sectors like construction. Pakistani cement companies have an opportunity to benefit from the construction package announced for Pakistan and also tap markets where post-development construction activities surge.

In Ramadan and afterwards, the market for dates, mangoes and citrus fruits can be tapped. Finally, the demand for anti-bacterial and anti-malaria sprays can also be tapped locally and internationally. As social distancing increases, people may increasingly use e-commerce which can increase the demand for motorcycles as well as create employment for a delivery segment.

Tapping these segments is vital to stay afloat and avoid massive unemployment. Pakistan Institute of Development Economics estimates that a prolonged lockdown can bring short-term unemployment to as many as 20 million people. Many of them would be looking after 2 or 3 dependents on average in their families. Unemployment can be contained if private sector business owners also play their role. Formal sector businesses can initiate work from home if the lockdown persists further. In Ramadan, the work hours are usually curtailed in the country. Work in multiple shifts and rotation policy among employees and industries can also be used to have a balance between work and social distancing. The government can give daily schedule as to which industries and types of businesses can be opened on which days. Since most utility companies are owned and operated by the government, the government can use the scheduling of utility access like electricity and gas to ensure smart lockdown with smart work.

Instead of layoffs, avoidable expenses need to be curtailed like advertising, organizing corporate events and deferring bonuses of senior executives. Industries which cannot operate for the time being can give employees leaves if they have in balance or give leaves on the account. When the lockdown ends and work resumes, the employees can be asked to provide work in lieu of leaves on the account. Finally, companies can also avail refinance scheme to manage their wage bills. The government can also introduce a similar scheme to finance overhead or by providing deferment of utility bills. A strong message and commitment from the government to support local industries post lockdown period will encourage businesses to hold onto their businesses.

The government has now allowed the industries to reopen in phases. It is hoped that the lower than expected growth in COVID-19 during the six weeks following the appearance of the first case in the country will allow the precarious economy to reopen sooner and come on its feet. However, it will require consistent efforts of all stakeholders including government, private sector, the philanthropic sector, overseas Pakistanis and civil society to mobilize resources and play an active, responsible, cooperative, vigilant and generous role.

The writer is Assistant Professor of Financial Economics at SZABIST University, Karachi and holds a PhD in Economics from the National University of Malaysia.