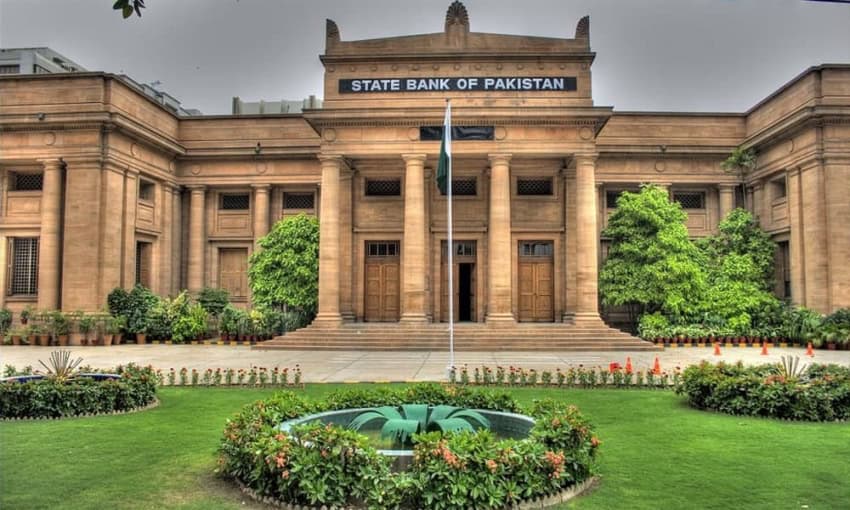

KARACHI – The State Bank of Pakistan (SBP) on Monday reduced the policy rate by 150 bps to 20.5 percent, effective from June 11, 2024.

This is the first time since June 2023 that the policy rate was revised as it remained unchanged during this year. This is also the first time in four years that the central bank has reduced the interest rate in four years.

The bank has attributed the cut in policy rate to moderate real GDP growth, declining international oil prices, positive ongoing talks with the IMF for another bailout package and reduction in current account deficit.

The MPC noted that while the significant decline in inflation since February was broadly in line with expectations, the May outturn was better than anticipated earlier.

The Committee assessed that underlying inflationary pressures are also subsiding amidst tight monetary policy stance, supported by fiscal consolidation. This is reflected by continued moderation in core inflation and ease in inflation expectations of both consumers and businesses in the latest surveys.

At the same time, the MPC viewed some upside risks to the near-term inflation outlook associated with the upcoming budgetary measures and uncertainty regarding future energy price adjustments.

Notwithstanding these risks and today’s decision, the Committee noted that the cumulative impact of the earlier monetary tightening is expected to keep inflationary pressures in check.

The MPC noted the following key developments since its last meeting.

“First, real GDP growth remained moderate at 2.4 percent in FY24 as per provisional data, with subdued recovery in industry and services partially offsetting the strong growth in agriculture.

Second, reduction in the current account deficit has helped improve the FX reserves to around US$9 billion despite large debt repayments and weak official inflows. The government has also approached the IMF for an Extended Fund Facility program, which is likely to unlock financial inflows that will help in further build-up of FX buffers.

“Lastly, international oil prices have declined, whereas non-oil commodity prices have continued to inch up.”

Based on these developments, the Committee, on balance, decided that it is now an appropriate time to reduce the policy rate. The Committee noted that the real interest rate still remains significantly positive, which is important to continue guiding inflation to the medium-term target of 5 – 7 percent.

More to follow…