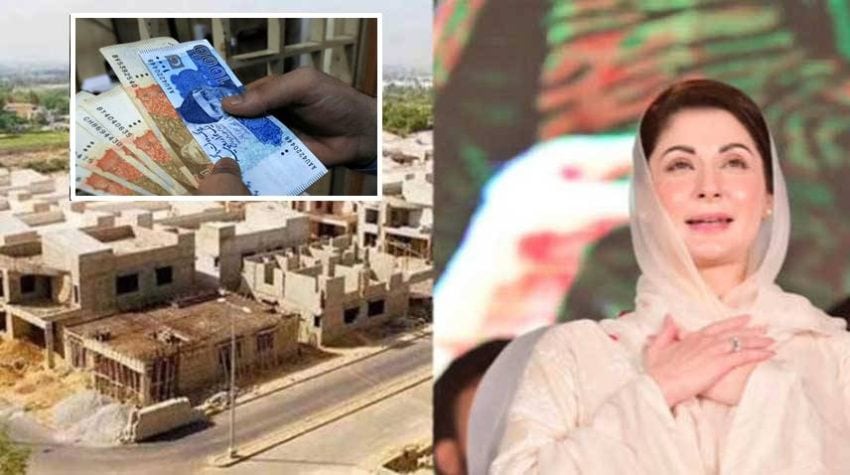

ISLAMABAD – ‘Apni Chhat, Apna Ghar’ scheme continues to bring joy and hope to thousands of families across Punjab to provide affordable housing for masses.

The program launched with the vision to make homeownership a reality for lower-income families, has also managed to recover loans worth a staggering Rs92.4 million which speaks of transparency and efficiency of the program.

More than 25,000 families have already been issued loans totaling over Rs26.97 billion, ensuring that financial support is being effectively provided to those in need. The program is also helping in the completion of homes by issuing the second installment for over 11,000 families, bringing them closer to their dreams of owning a house.

Apni Chat Apna Ghar Scheme 2025 Update

With a focus on inclusivity, the program offers housing loans for homes ranging from 1 to 5 marlas in urban areas and up to 10 marlas for rural plot owners. What sets this initiative apart is its ease of access – applicants can apply for loans from the comfort of their homes, making the process simpler and more convenient than ever.

Punjab Chief Minister Maryam Nawaz, commended the historic moment, as she aimed to empower more people to realize their dreams of having a home.

‘Apni Chhat, Apna Ghar’

Following are requisites for applying

- Residency: The applicant or a family member must be a permanent resident of Punjab, as evidenced by their CNIC.

- Land Ownership: The applicant must be the exclusive owner of a plot of land, measuring up to 5 Marlas in urban areas or up to 10 Marlas in rural areas within Punjab. The land must be intended for constructing the applicant’s residence at the time of submitting the online application.

- No Criminal History: The applicant should not have any criminal convictions, particularly related to anti-state activities, anti-social behavior, or serious crimes.

- Loan Repayment: The applicant should not have any outstanding loans or defaults with financial institutions or banks.