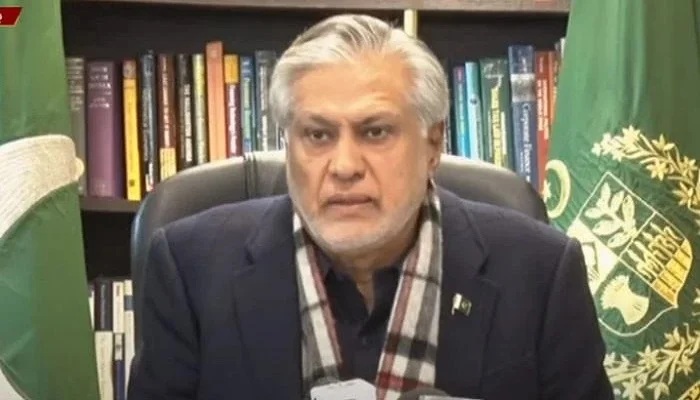

ISLAMABAD – Minister for Finance and Revenue Senator Ishaq Dar on Wednesday tabled the Supplementary Finance Bill 2023, being dubbed as the mini-budget by public and opposition, to meet the preconditions placed by the International Monetary Fund (IMF) to receive ninth tranche of loan.

The government has proposed taxes on several sectors in order to shrink the budget deficit and increase the tax base. Here is what has been proposed by the finance minister in the supplementary bill;

- Increase in GST on luxury items from 17% to 25%

- Increase in FED on business and first-class air by Rs20,000 or 50%

- 10% withholding adjustable advance income tax to be imposed on bills of wedding functions

- Increase in FED on cigarettes, soft and sugary drinks — from Rs1.5 per kg to Rs2 per kg

- Increase in GST from standard 17% to 18%

- GST to not be imposed on essential goods — wheat, rice, milk, pulses, vegetables, fruits, fish, eggs, meat

Last night, the government jacked up the general sales tax (GST) rate from 17 to 18% and increased the Federal Excise Duty (FED) on cigarettes to collect additional Rs115 billion.

President Arif Alvi on Tuesday denied a request made by the government for promulgating an ordinance to impose new taxes as it is making efforts to raise additional revenue to revive the IMF programme.

Finance Minister Ishaq Dar called on the president and apprised him about the progress in talks with the IMF delegation on the ninth review stalled since September 2022 amid depleting foreign exchange reserves held by the State Bank of Pakistan (SBP).

The president, according to the state broadcaster, appreciated the efforts of the government for an agreement with the IMF, and assured that the state would stand by the commitments made by the government with the IMF.

During the meeting, the minister informed that the government wanted to raise additional revenue through taxes by promulgating an ordinance.

However, the President advised that it would be more appropriate to take the Parliament into confidence on this important subject, and that a session be called immediately so that the bill is enacted without delay.

Last week, Dar on Friday said that the talks the global lender concluded “positively” and the government will have to impose Rs170 billion in taxes through a ‘mini-budget’ in order to get the loan programme.

IMF issues statement after concluding 10-day talks with Pakistani officials