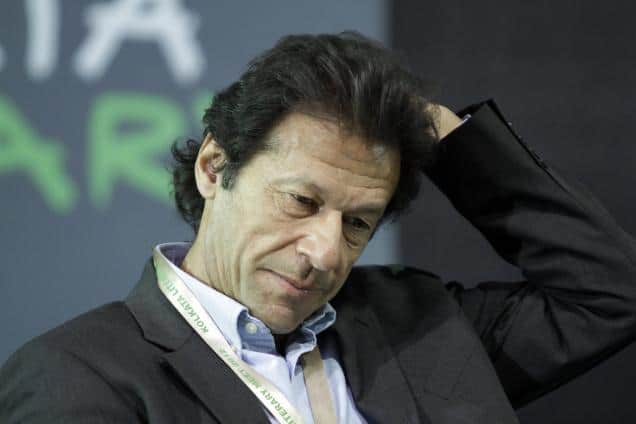

ISLAMABAD (News Desk) – Pakistan Tehreek-e-Insaf chief Imran Khan may have benefited from the 2000 Tax Amnesty Scheme through which he declared ownership of his London flat, according to media reports on Thursday.

According to The News International’s report, Imran Khan began filing his tax returns in Pakistan in 1982 and bought his London flat in 1983.

However, according to his assets declaration documents, the PTI chief did not declare ownership of the flat with the FBR until 2000, when then President Pervez Musharraf announced a tax amnesty scheme. He also failed to declare ownership of the offshore entity named Niazi Services Limited in his tax returns.

Despite benefiting from the tax amnesty scheme in the Musharraf era, Khan has been critical of Tax Amnesty schemes in the past, especially the one launched by the incumbent government this year, which has largely been structured to bring non-tax filing traders into the tax net.

Related: Imran Khan admits he owned offshore company

Furthermore, in his 2001 tax documents, Imran Khan mentioned owning a Rs. 20,00,000 worth flat in London. But, contrary to Khan’s claim, the report said that the flat located in London’s South Kingston area was bought for Rs. 24,38,000.

Responding to the allegations, the legal counsel for Imran Khan, Yousuf Ali Chaudhry, said that Pakistan’s tax law did not necessarily demand citizens to declare their foreign assets before 1999. That is why Imran Khan was fully justified to mention only Pakistani assets in his tax returns.

However, he declared the ownership of his London flat in 2001, after then government amended the tax laws, he said.

Read more: Media group publishes lies in the name of Panama Papers