KARACHI: Samba Bank Limited signed an agreement with Techlogix Mobility Pakistan to launch a digital lending platform that streamlines online personal loan applications for salaried individuals.

The Digital Loan is a short term and affordable loan product having a maturity of one month delivered entirely via digital channels and disbursed in less than 30 seconds. Applying for a digital loan through a mobile application offers several advantages for consumers like greater accessibility, transparency and the ability to apply for loans quickly and remotely.

Samba Bank will require no in-person interaction to apply for a digital loan. Loan decision processes, including loan application and credit limit assessment, are streamlined as they run through a series of preset algorithmic decision trees; no manual, case-by-case approval or rejection decision is made. As such, the digital loan can be accessed instantly unlike conventional loans.

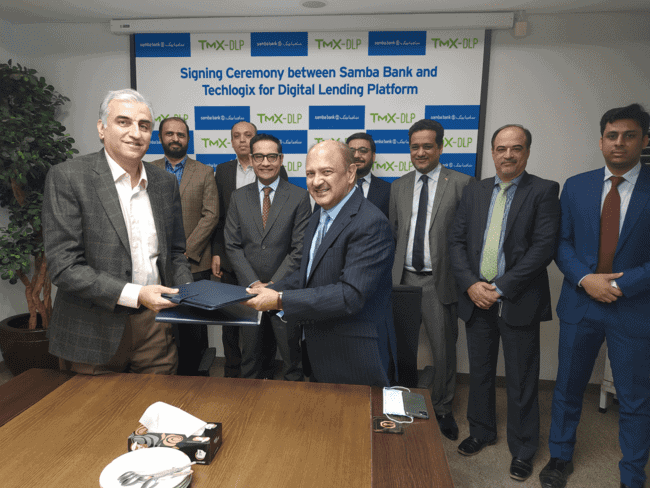

Mr Salman Akhtar, CEO – Techlogix and Mr Shahid Sattar, President and CEO – Samba Bank Limited, signed the agreement in presence of team members from both organizations. Team members from Samba Bank included Mr Talal Javed, Group Head Consumer Banking, Mr Zeeshan Kaiser, Group Head IT, Mr Amir Hussain Arab, Chief Digital Officer and Fakhr-e-Imtiaz, Head of Consumer Assets. Mr Arsalan Ahmed and Adeel Ahmed were representing Techlogix during the ceremony.

Speaking on the occasion, Mr Salman Akhtar, CEO – TMX, said “We are delighted to work with a visionary institution like Samba Bank which is transforming its business operations with digital channels. Our Digital Lending solution will help increase access to credit and help the Bank provide additional value-added services to its customers.”

Mr Shahid Sattar, President and CEO – Samba Bank Limited, said “We are very excited to partner with Techlogix to offer digital loans to our payroll customer base. Samba Bank focused on providing innovative digital solutions by adopting robust technology platforms. We are committed to enhancing customer experience by adding multiple financial products in our Samba Smart Mobile App. The addition of the digital loan product is just a first step in providing our customers with a whole range of deposit and lending products digitally via the Mobile App.”