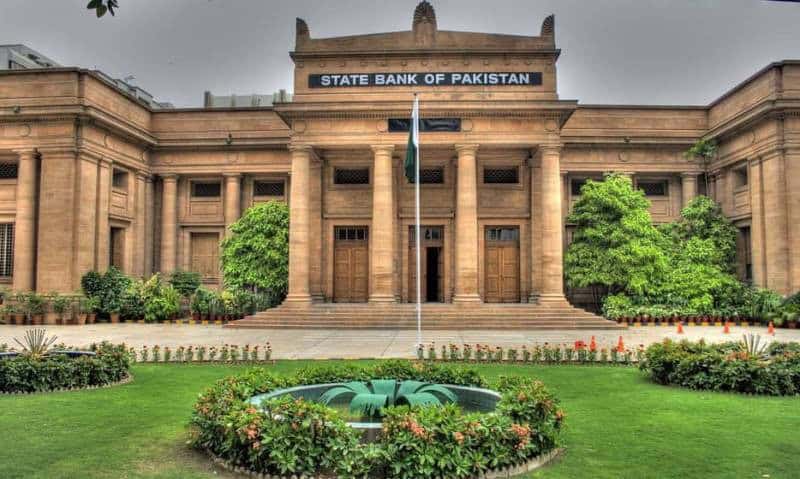

KARACHI – The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) Monday decided to keep the policy rate unchanged at 22 percent.

The Committee noted that the macroeconomic stabilization measures are contributing to considerable improvement in both inflation and external position, amidst moderate economic recovery.

However, the MPC viewed that the level of inflation is still high. At the same time, global commodity prices appear to have bottomed out with resilient global growth. The recent geopolitical events have also added uncertainty about their outlook.

Moreover, the upcoming budgetary measures may have implications for the near-term inflation outlook.

On balance, the Committee stressed on continuation of the current monetary policy stance to bring inflation down to the target range of 5 – 7 percent by September 2025.

Since its last meeting, the MPC noted following key developments. First, data for the first half of FY24 suggests that economic activity is recovering at a moderate pace, led by strong rebound in agriculture sector.

Second, the current account recorded a sizable surplus in March 2024, which helped to stabilize the SBP’s FX reserves despite substantial debt repayments and weak financial inflows.

Third, inflation expectations of consumers inched up in April 2024, whereas those for businesses declined.

And lastly, leading central banks particularly in advanced economies have adopted cautious policy stance after noticing some slowdown in the pace of disinflation in recent months.

State Bank of Pakistan expected to cut policy rate by 100-150 basis points