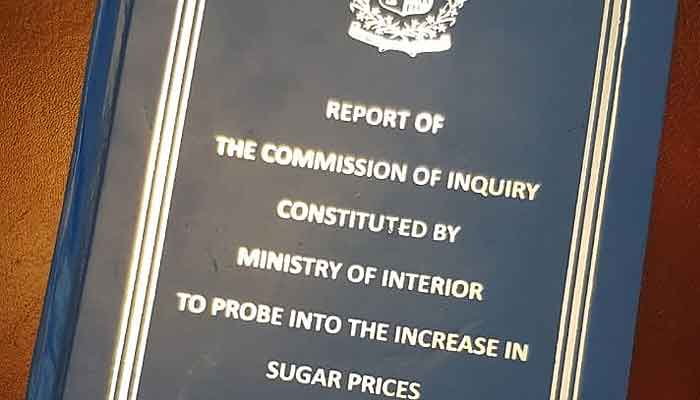

ISLAMABAD – PTI government on Thursday declared the findings of the inquiry report on the sugar crisis public.

PM Imran Khan’s aide on accountability, made the much-awaited sugar inquiry report public in the federal capital.

Click Here for Complete Sugar Inquiry Report

According to the report, Prime Minister Imran Khan’s close aides, top PTI, and opposition leaders were founded guilty as the federal cabinet has decided to make the forensic report made public.

Federal Investigation Agency (FIA) Director General Wajid Zia presented the 200-page report prepared by a high-powered inquiry commission in the meeting chaired by Prime Minister Imran Khan.

The prime minister has fulfilled its another promise as he has ordered to make the report public despite his ministers and party leaders have been named as guilty in the forensic report.

As per local media, Asad Umar, Razzaq Dawood, Jahangir Tareen, Khusro Bakhtiar, Monis Elahi, Salman Shehbaz are among others who have been found guilty.

Later in the day, Shahzad Akbar, special assistant to the prime minister on accountability, held a press conference to unveil the findings.

The biggest revelation is that they have been manipulating the cost of production (showing higher cost than actual cost). The sugar industry manipulated the cost of production to maximize its gains and claim a subsidy. A one rupee manipulation in the cost of production translates into a windfall gain of Rs5.2 billion. In the last five years, the industry has been manipulating the cost by Rs10, Rs12, and Rs15 each year.

Sugar consumption in the country is 5.2 million metric tonnes. In the last five years, the sugar industry got Rs29 billion in a subsidy but paid Rs22 billion in income tax as a whole and the refunds they claim were Rs12 billion.

There are 88 sugar mills which got Rs29 billion in subsidies during the last five years, but the net income tax paid by them was Rs10 billion.

Shahzad Akbar said the report explicitly says that sugar mill owners pay the amount to sugarcane growers even less than the support price. In addition, all sugar mills make cuts in the weight of sugarcane from 15 to 30 percent.

Shahzad Akbar said Commission also found irregularities in the form of giving advance payments to farmers in the form of cash or commodity, which is akin to unregulated banking.

It was also found in the report that the total income tax of around 88 sugar mills of the country is ten billion rupees, after getting a tax refund. Shehzad said six big groups of Pakistan have a 51 percent share of the sugar industry.