By Our Reporter

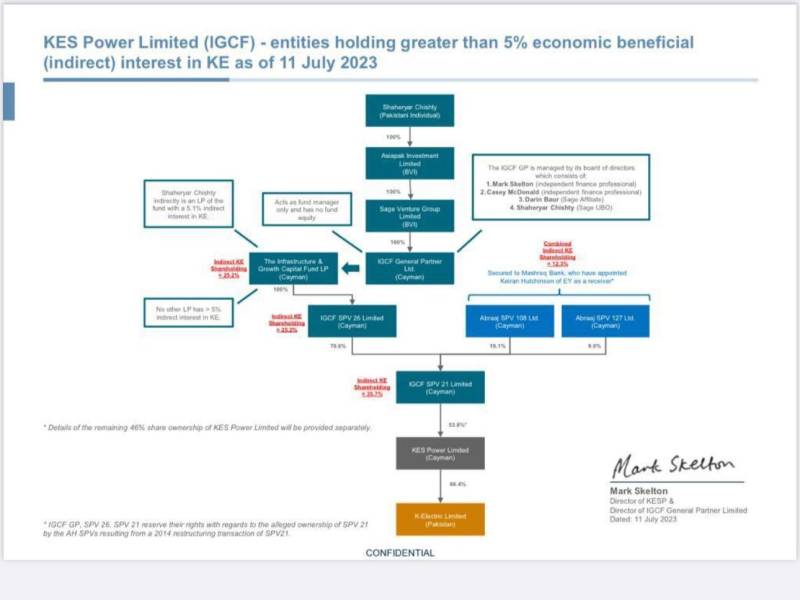

KARACHI – The Karachi Electric (KE) Chairman, Mark Skelton, has certified that Shehryar Chishti’s indirect beneficial ownership in KE, through the Infrastructure and Growth Capital Fund (IGCF Fund), is only 5.1%.

This is a startling turn of events contradicts previous numerous portrayals by Shehryar Chishti as a majority shareholder in the company, KE.

Leaked documents from Alvarez and Marsal, a renowned international consulting firm, shows that Shehryar Chishti’s indirectly is an LP (Limited Partner) of the IGCF Fund “with a 5.1 % indirect interest in KE”.

The document, available with this paper, is signed by Mark Skelton who is the current Chairman of KE and the Chairman of Cayman Island registered KES Power Limited (KESP), the parent entity of KE. Skelton also holds the position as Director of IGCF General Partner Limited, who is the manager of the IGCF Fund. Skelton is also the Managing Director of Alvarez & Marsal Europe LLP.

The document, carrying the revelation, was signed by the Chairman of KE and KESP on 11 July 2023 for a legal filing. The verified document is titled “KES Power Limited (IGCF) – entities holding greater than 5% economic beneficial (indirect) interest in KE as of 11 July 2023.”

A debate has raged in Pakistani media in recent months where Shehryar Chishti claimed he has become the “majority” owner of K Electric Limited, with numerous reports suggesting that he holds a substantial ownership stake in the company.

The original Saudi and Kuwaiti investors, Al-Jomaih and NIG, have throughout rejected the claim saying they hold over 30.7% indirect share in KE and that the majority ownership claim bv Shehryar Chishti is misleading. This notion has now been reinforced by the certified document from the Chairman of KE and KESP.

The leaked document, obtained from anonymous sources, provide undeniable evidence to bring out the reality as these carry signatures of Mark Skelton, the Chairman of KE, and raises several questions.

The certified document contains detailed ownership information and structure details that expose the true extent of IGCF Fund’s involvement in K-Electric. The document also reveals that approximately 30% of IGCF SPV 21, the third shareholder in KESP (apart from the Saudi and Kuwait groups), is held by Mashreq Bank. This effectively translates into Mashreq Bank holding 10.5% indirect stake in KE. Comparing this to the ownership stake of Chishti as a Limited Partner / Investor in the IGCF Fund, Chishti’s see-through ownership turns out to be only 5.1% i.e., less than half of that of Mashreq Bank.

Chishti’s economic stake in KE comes about from purchasing Limited Partners interests from various investors in the IGCF Fund. Originally there were over eighty investors in the IGCF Fund established in 2008. With investment horizon spanning over fifteen years, much beyond the originally envisaged life of the Fund, investor fatigue had set in and many investors in the IGCF Fund simply wanted to cash out.

Hence the pecking order of indirect ownership in KE would start at the top with the largest chunk held by the original investors in KE, since the time of Privatization back in 2005, being the Saudi and Kuwait conglomerates (30.7%). Next in line would be Mashreq Bank (10.5%) which sort of inherited the stake due to the misfortunes of Abraaj group now in liquidation. The smallest portion, amongst these four groups, belonging to Chishti (5.1%) through his offshore entity in British Virgin Islands (BVI).

The exposure of the real ownership structure of K Electric has led to significant consequences in various quarters. Investors and stakeholders who relied on the previous media portrayal are now grappling with the new reality.

Legal experts have also started scrutinizing the implications of this revelation. Questions about the integrity of financial disclosures, corporate governance, and regulatory oversight are being raised. The sudden change in the perception of the company’s ownership has opened the door to potential legal challenges and investigations. Moreover, this incident brings out the importance of accurate and transparent reporting in the corporate world.

The uncovering of Shehryar Chishti’s actual stake in KE serves as a cautionary tale about the power of misinformation and the need for accurate, verified information. The uncertainty arising from concealed and non-transparent transactions conducted by Sage, a BVI company owned by Chishti are now being revealed to the public at large.

This incident also emphasizes the role of investigative journalism in uncovering the truth behind corporate narratives. It brings out the importance of independent media in holding powerful entities accountable and informing the public with accurate information.

It also brings forth the supervisory role of regulatory authorities to inquire and investigate the reality behind concealed transactions in offshore jurisdictions especially when such transactions concern assets of national security of Pakistan.