ISLAMABAD – Pakistan has made changes to its budget for next fiscal year in a last-ditch effort to woo International Monetary Fund as talks on bailout funds remain halted for months.

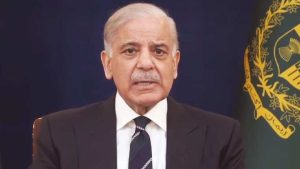

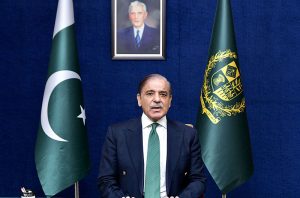

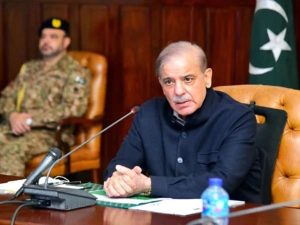

The government rolled out new taxes worth Rs215 billion rupees to comply with stern conditions tabled by the US-based lender in the aftermath of a crucial meeting of Prime Minister Shehbaz Sharif and the Funds chief.

In the latest changes, the government put more tax burden on the salaried class, which is already bearing the brunt amid record inflation.

With the latest amendment, Pakistanis who are earning over Rs2lac per month will get another 2.5 percent tax under the new proposals. As of now people in this tax slab are paying 20 percent in income tax but it will now be jacked up to 22.5pc.

In an announcement, the country’s top tax collection authority said the current income tax rate for the slabs starting from 20pc and onwards for the salaried and non-salaried business classes have been proposed to be increased by 2.5 percent.

Likewise, the tax slabs starting from 20 percent onwards for business classes are also proposed to be increased by the same anmount.

With these taxes, the government aimed to garner Rs30 billion from salaried and non-salaried individuals as the country is facing all possible options to generate funds amid facing debt crisis.

Budget 2023-24: Punjab cabinet approves increase in salaries, pensions of government employees