ISLAMABAD – Pakistan’s biggest Telecommunication provider, Jazz faces the closure of its head office after the The Federal Board of Revenue maintained that the telco has not paid taxes amounting over Rs 25 billion.

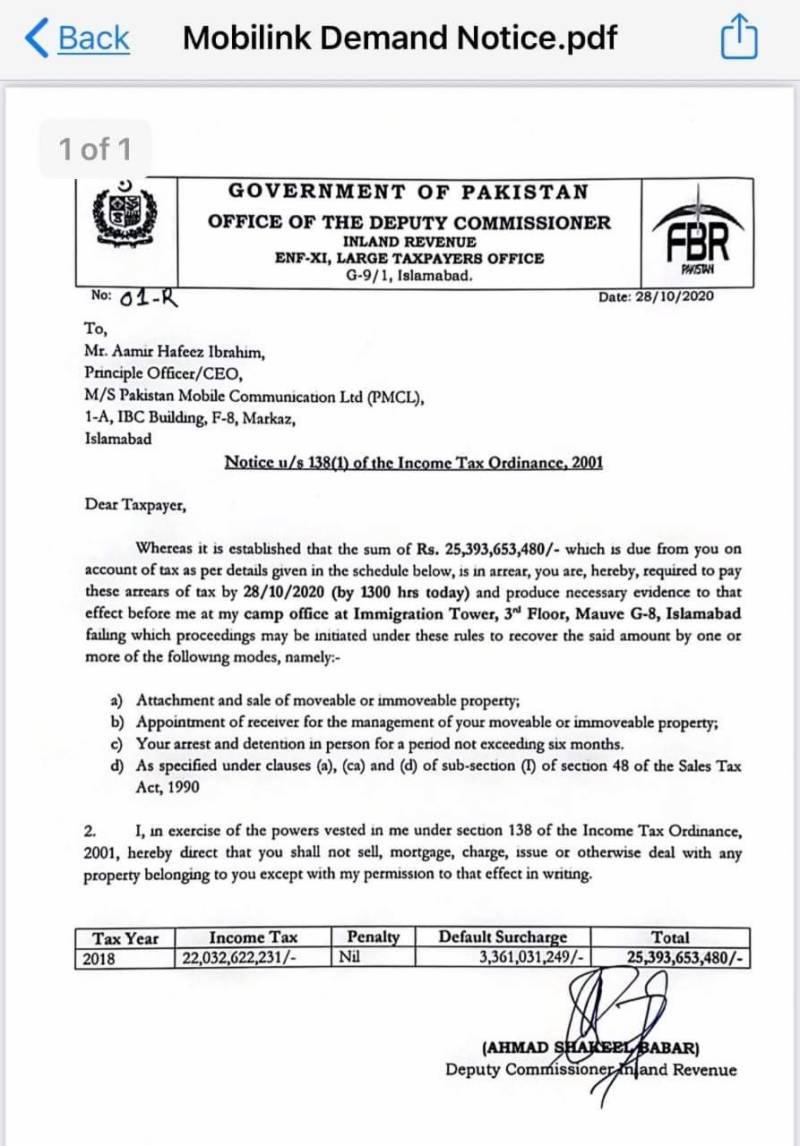

In an order, the FBR stated that the Income Tax amount of Rs 25,393,653,480 is outstanding against the defaulter (Jazz) while the defaulter is refraining itself “deliberately, dishonestly and without lawful excuse to discharge tax liability and thus causing huge loss to the national exchequer.”

“Therefore, on the basis of facts stated inter alia, I, Ahmad Shakeel Babar, Deputy Commissioner Inland Revenue, in the exercise of the powers vested in me in terms of section 138 of the Income Tax Ordinance, 2001 read with section 48 of the Sales Tax Act, 1990, order to seal the business premises of the defaulter till the payment of outstanding dues in full or withdrawal of this order.”

“Therefore, on the basis of facts stated inter alia, I, Ahmad Shakeel Babar, Deputy Commissioner Inland Revenue, in the exercise of the powers vested in me in terms of section 138 of the Income Tax Ordinance, 2001 read with section 48 of the Sales Tax Act, 1990, order to seal the business premises of the defaulter till the payment of outstanding dues in full or withdrawal of this order.”

According to the FBR order, a copy of which is available with DailyPakistan, the head office of Jazz in Islamabad will remain sealed till the payment of outstanding dues in full or withdrawal of this order.

The document further stated that any non-compliance/defiance to this order shall be tantamount to obstruction in the discharge of functions of an income tax authority and shall be punishable on conviction with a fine or imprisonment for a term not exceeding one year or both under section 196 of the Income Tax Ordinance, 2001.

As per the Jazz officials, a spokesperson told that the company is a law-abiding and responsible corporate citizen, with significant contribution to Pakistan’s economy over the past 25 years.

“We have received a notice from FBR this afternoon. Jazz has made tax submissions based on legal interpretations of the tax owed. We will review and take measures under our legal obligations and will collaborate with all concerned institutions for an early resolution of this issue,” he added.

Reaction from Jazz

The telecom company has condemned the FBR move to seal its office over non-payment of taxes.

Jazz Spokesperson said, “We have received a notice from FBR yesterday for the recovery of a disputed tax demand and we have serious reservations on these alleged taxes. The proceedings were carried out on plea of a tax recovery notice for a disputed amount from 2018 which is under legal proceedings. Due to the drastic measures our corporate reputation and pride has been hurt and shakes the confidence of foreign investors of Jazz and others. Despite being the largest taxpayers, we are treated in an unfortunate way. While the government is making efforts to improve the business environment in the country, such drastic measures would unfortunately severely affect investment prospects.”

In the statement, Jazz highlighted that it has contributed over Rs251 billion to the national exchequer in the form of taxes and duties in the last six years.

Terming Jazz as law-abiding corporate citizen, the statement highlighted the participation of the firm is the relief works.

“Jazz seeks resolution of the matter and has always been willing to conduct dialogue as well as rightful legal course to reach merit and right interpretation. Jazz also assures its valued customers that despite the challenges, we will continue to provide uninterrupted services,” said the statement.