The National Savings, also known as Qaumi Bachat Bank, has disclosed the revised profit rate for Behbood Savings Certificates and other schemes effective from April 2024.

Introduced by the government in 2003 to address the financial challenges encountered by widows and the elderly, Behbood Savings Certificates offer monthly profits at reasonable rates.

On March 19, the government increased the profit rates on Behbood Certificates, currently fixed at 15.60%.

Effective Period: Till Date

Monthly Profit on each Rs100,000: Rs1,300

Rate (%): 15.6%

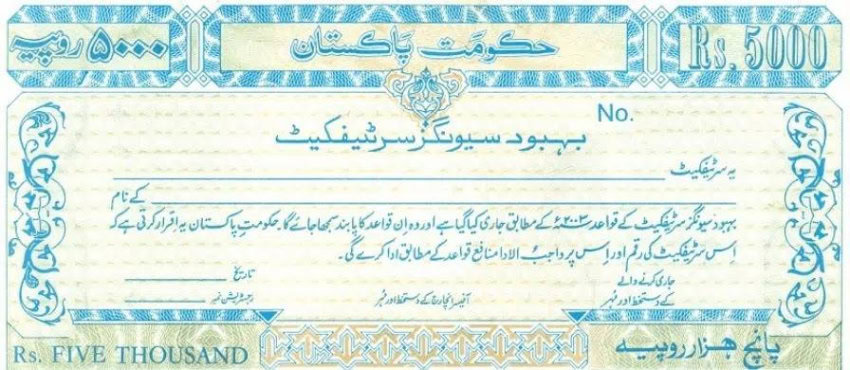

Originally extended to disabled individuals and special minors with disabilities through their guardians in 2004, Behbood Savings Certificates are available in denominations ranging from Rs5,000 to Rs1,000,000. Profit is disbursed on a monthly basis, commencing from the date of purchase of the certificates.

Who can purchase Certificates?

Behbood Savings Certificates can be acquired by the following categories of Pakistani citizens:

1. Senior citizens aged sixty years or above

2. Single widows, provided they do not remarry

3. Two eligible persons, as mentioned above, in their joint names

4. Individuals with disabilities holding NIC with Disability logo, and special minors through a guardian

Investment Limit

The minimum investment limit for Behbood Savings Certificates is Rs5,000, while a single person can invest a maximum of Rs7.5 million. For joint investors, the limit stands at Rs15 million.

In April 2024, the government has set the new profit rate for Behbood Savings Certificates at 15.6%, ensuring continued financial support for eligible individuals.