By Our Correspondent

KARACHI/WASHINGTON — The Resource Group International Limited (TRG) is in serious trouble over the continuing fall of its revenue and other serious setbacks that have rocked the company.

It has emerged that TRG was coming close to collapse, with revenues at its principal subsidiaries Afiniti and Ibex falling dramatically, the company shifting heavily into losses, and the value of its investments falling dramatically.

According to sources within the company, operating losses at Afiniti are now approximately RS 30 billion a year with the picture continuing to deteriorate, while operating profits at Ibex are down more than 25%.

A senior management figure at the company in Pakistan has been accused of covering up his sexual harassment at Afiniti, according to insiders.

One of the insiders said: “Something seems to have gone seriously wrong since TRG management announced a rosy prospects for the company last year on the back of what they claimed was a turnaround they engineered after ousting the founder, Mr Zia Chishti. Instead, the current management now stands accused of fraud and presiding over a catastrophic business picture while pursuing its own personal goals. The company is apparently illegally purchasing its own shares through a subsidiary to prop up the share price, which otherwise would be headed towards zero, with management acting against State Bank regulations and dodging taxes.”

In response, the former CEO and founder Mr. Zia Chishti initiated a process for removal of the board through a shareholder vote. Sources say the company and its management seems unwilling to face its shareholders and went to court to get a stay order. “Let’s see how long it lasts, and if Mr. Chishti can move fast enough to save the business,” said the source, requesting anonymity.

When asked for comment, Mr. Chishti stated he stands behind his accusations and welcomes an investigation of all of them.

Despite multiple attempts to contact TRG management and board members, none of them would provide clear comment on the allegations raised against them, nor would they comment on the fact that TRG stock has collapsed under their leadership and is now trading under the dollar value where Mr. Chishti left the Company in November 2021.

One investor said: “The stock market, however, is pretty clear that the current management – Mohammed Khaishgi and Hasnain Aslam need to go. These people told lies when they took control of the company in 2022 and have been lying to us since, covering up a disaster. If they are not gone quickly, one of Pakistan’s great hopes will be destroyed. TRG was the future of the country.”

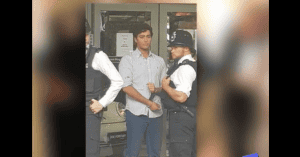

In February this year, a District & Sessions Judge in Karachi ordered issuance of bailable arrest warrants for various individuals associated with TRG. The arrest warrants come after the judge took cognizance in a criminal defamation suit filed by complainant Zia Chishti, the founder of TRG Group.

The accused comprise of board of directors and senior management at the TRG International. These include Mohammad Khaishgi (CEO and Chairman of TRG International and Chairman of TRG Pakistan), Hasnain Aslam (Director TRG International and CEO of TRG Pakistan), Pat Costello (General Counsel TRG International), Hassan Farooq (Group Director Finance TRG International).

The millionaire founder of Invisalign left Afiniti after accusations of grooming and sexual assault in 2021 by a former employee – allegations that he has denied robustly.

The sex assault claim emerged when Tatiana Spottiswoode testified to Congress that she had been left with injuries after a work trip with Chishti. Chishti denies the allegations and has launched defamation proceedings against her for $500m. He has stressed that everything that took place between the two was consensual and in agreement.

Chishti is demanding $500 million in compensation for himself and his wife, Sarah Pobereskin, for financial and psychological harm. His lawsuit states that Spottiswoode “weaponized” their affair in Congress.

Cameron quits, Chishti ousted after Afiniti hit with sexual assault allegations